Part 2: Inputs, Assumptions, and Feedback

At OFC 2021– held online in June of that year – 400ZR performance claims, press releases, interoperability tests, and product announcements dominated the proceedings (see Cignal AI’s Active Insight “OFC 2021: 400ZR/ZR+”). After years of anticipation, modules were finally about to reach general availability and initial deployments were imminent. After this frenzy of hype, Cignal AI initially assessed the impact of IP-over-DWDM on the optical transport systems market in late 2021 (see Active Insight “400ZR IPoDWDM – Market Impact and Forecast”).

Eighteen months and a quarter-million units later, 400ZR and its variants (collectively referred to as 400ZRx) have experienced the fastest ramp of any coherent generation, and a clearer picture of the market and its trajectory has emerged.

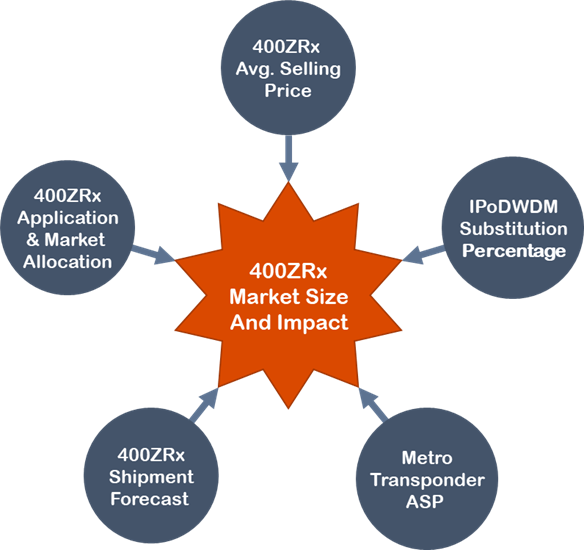

It’s an opportune moment to reassess the size of the 400ZRx market and the impact these pluggables will have on the optical transport systems market, which is the focus of this Active Insight series.

- Part 1, “Is IP-over-DWDM Ready to Cross the Chasm?” discussed how innovations in 400ZRx optics will propel IP-over-DWDM into mainstream adoption among Service Providers. New capabilities such as high output power, transport-oriented management, and higher baud rates will overcome many obstacles hindering adoption among conservative and operationally rigid Telcos.

- Part 2 (the one you’re reading now) outlines the methodology used to assess the size of the 400ZRx market and the impact of IP-over-DWDM on the optical transport systems market. It explains the inputs, assumptions, and methodology of the model. There’s also a survey where you can weigh in on some of the model’s inputs.

- Part 3 of the series (future release) will use the inputs and methodology outlined in Part 2 to quantify the size of the 400ZRx market and the impact of IP-over-DWDM on the optical transport systems market. These will then be used to update the forecast for the Metro Optical hardware and Customer Markets forecasts – with and without router-based IP-over-DWDM optics.

For this exercise, which forecasts through 2026, we’re considering only 400ZRx, or Gen60C, optics in Metro applications. Long-haul capable Gen120C optics (800ZRx) are on the horizon, but their impact will be small and primarily limited to hyperscale DCI within this timeframe. Future updates will include them. The model is also limited to the ex-China market. Not only are the optical and routing markets in China largely closed to non-Chinese vendors (and the modules they sell), but it’s also a market in which IP-over-DWDM is unlikely to see material deployment for the foreseeable future.

Summary

400ZRx optics and IP-over-DWDM will profoundly impact how networks are built and will shift coherent optics revenue from optical transport systems to module and router vendors. Forecasting this impact involves making assumptions that are uncertain and highly subjective. By collecting input from our readers, we can refine our assumptions and improve the model.

Keep an eye out for Part 3, which will forecast the size of the 400ZRx module market through 2026 and quantify the impact of IP-over-DWDM on the optical transport market. These results will then be used to update the Metro Optical hardware and Customer Market forecasts – with and without router-based IP-over-DWDM optics.