Enhanced Applications Report Adds 400ZR+ and 100ZR Coherent Port Forecast

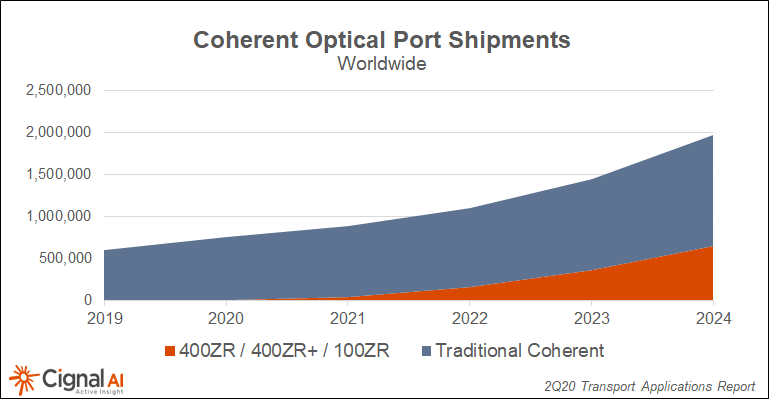

BOSTON (September 24, 2020) – Adoption of coherent pluggable optics will accelerate in 2021 as new technologies reach the market, according to the latest Transport Applications Report from networking component and equipment market research firm Cignal AI. Fourth-generation coherent will extend beyond 400ZR to include higher performance solutions generally referred to as 400ZR+ and lower speed 100Gbps (100ZR) targeted at the metro edge.

“Standardized pluggable coherent optics, coupled with open line systems and network control, will represent a major change in network design,” said Andrew Schmitt, Directing Analyst for Cignal AI. “This shift will begin in earnest in 2022.”

After cloud operators initially provided a business case for 400ZR to component suppliers, those suppliers then designed and adapted products to address broader use cases such as higher performance 400Gbps and pluggable 100Gbps coherent. Incumbent, Wholesale, and Cable MSO operators still account for most of the global optical transport spending, and these operators will determine what role the new pluggable coherent optics will play in their networks. Cignal AI anticipates that pluggable coherent will cannibalize some standalone optical equipment, but new applications such as metro-edge connections for enterprises and 5G represent the largest near-term opportunity.

Further analysis is detailed in Cignal AI’s Optical Transport Applications Report, which is released quarterly. The latest 2Q20 issue updates market share for the second quarter of 2020 and provides forecasts in three key markets: compact modular equipment, advanced packet-OTN switching hardware, and coherent WDM port shipments.

Other key findings in the 2Q20 report include:

- 400ZR, 400ZR+, and 100ZR should enable roughly a third of metro and long-haul connections by 2024, and significantly transform network design.

- Global shipments of 400Gbps coherent doubled from last quarter and are now Ciena’s #1 product. Shipments from other vendors such as Infinera and Cisco have yet to reach large volumes.

- Traditional 100Gbps coherent shipments declined, as Chinese vendors continue to move to 200Gbps speeds in proprietary pluggable and non-pluggable formats.

- Compact Modular sales grew much faster than the overall market this quarter as disaggregation continues to gain traction in networks outside of Cloud & Colo.

- Ciena’s market share of Compact Modular flattened as Infinera, Huawei, and ADVA sales ramp.

- Packet-OTN sales grew outside of NA. Spending remains focused in APAC, accounting for over 60% of worldwide sales this quarter.

About the Transport Applications Report

The Cignal AI Transport Applications Report includes market share and forecasts for revenue and port shipments for optical equipment designed to meet specific applications; coherent optical technology and compact modular and advanced packet-OTN switching hardware. Deliverables include an Excel file with complete data set, PowerPoint summary, live Presentation of results, and Active Insight market news reports on significant industry developments.

The Transport Applications Report features revenue-based market size and share for the hardware categories and detailed port-based market size and vendor market share for 100G+ shipments. Vendors examined include Acacia, Adtran, ADVA, Ciena, Cisco, Ekinops, Fujitsu, Huawei, Infinera, Inphi, NEC, Nokia, NTT Electronics (NEL), Ribbon, and ZTE.

Full report details and articles and presentations are available to clients who register an account on the Cignal AI website.

About Cignal AI

Cignal AI provides active and insightful market research for the networking component and equipment market and its end customers. Our work blends expertise from various disciplines to create a uniquely informed perspective on the evolution of networking communications.

Contact Us/Purchase ReportSales: [email protected]

Web: Contact us