Nearly Half a Million Coherent Ports Shipped in the Last 12 Months

BOSTON (September 18, 2019) – Sales of Compact Modular optical transport platforms slowed during the second quarter of the year despite significant growth from market leader Ciena, as reported in the latest Optical Applications Report from market research firm Cignal AI. Production shipments of new 600Gbps platforms are taking longer to ramp as operators require more time to evaluate these next-generation solutions. As a result, Cignal AI has decreased the overall 2019 Compact Modular sales forecast for the year.

The outlook for Compact Modular equipment remains positive, especially in NA and EMEA where growth is strong as incumbent and cloud & colo operators expand the use of disaggregated networks. Compact modular will claim a greater percentage of the market as operators migrate to IP-over-DWDM in 2022/2023.

“The move to disaggregated networks continues, and Compact Modular optical platforms are a central part of those network designs,” said Scott Wilkinson, Lead Analyst for Optical Hardware and Cignal AI. “The rollout of 600Gbps platforms is taking longer than anticipated, but NEL and Acacia-based systems from Cisco, Infinera, and others should recognize greater revenue in the third quarter and will lead a return to growth.”

Cignal AI’s 2Q19 Optical Applications Report details market share and provides forecasts through 2023 in three key markets: compact modular equipment, advanced packet-OTN switching hardware, and 100G+ coherent WDM port shipments across multiple speeds.

Additional 2Q19 Applications Report Findings:

- Ciena maintained leadership in the Compact Modular market and was the only vendor to grow sales in Q2. Other vendors are in the middle of a customer transition to higher 400G+ coherent technology.

- Cisco recognized token revenue from Acacia-based Compact Modular systems this quarter. Both Cisco and Infinera are expected to recognize significant 400Gbps+ revenue in the third quarter.

- Packet-OTN sales slowed in APAC but this is not an enduring trend; sales growth slowed in Q2 due to some delayed demand among Indian incumbents. This region remains the largest market for Packet-OTN.

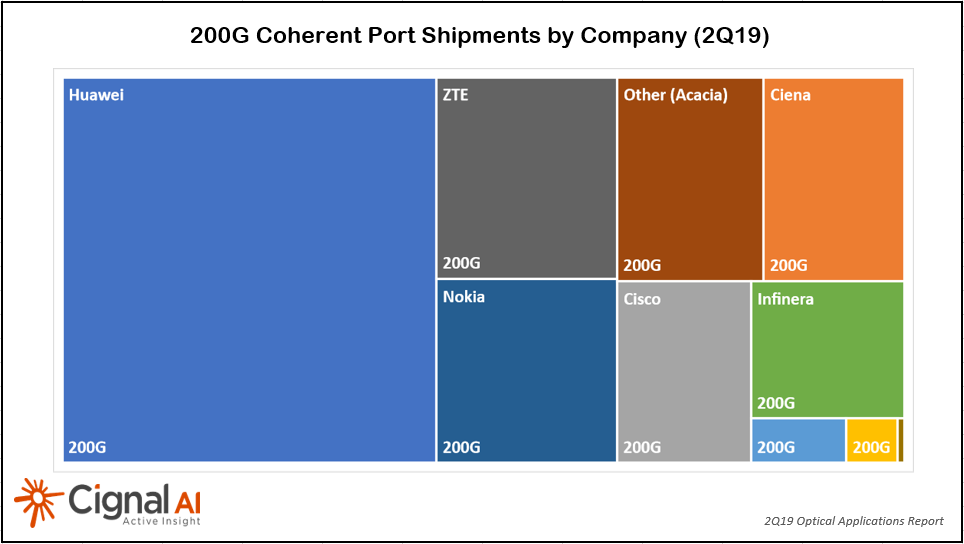

- Almost 500,000 coherent ports shipped during the past twelve months, with the vast majority coming from the top 5 vendors. Volume continues to aggressively ramp during 2019, including healthy shipments from Chinese vendors.

- The long haul WDM market is growing in 2019 due to deployments of the latest coherent technology. Metro growth continues through the year with a delay in competitive price pressure from high baud rate optics.

About the Optical Applications Report

The Cignal AI Optical Applications Report includes market share and forecasts for revenue and port shipments for optical equipment designed to meet the needs of specific applications: 100G+ coherent, and compact modular and advanced packet-OTN switching hardware.

Vendors examined include Acacia, ADVA, Ciena, Cisco, ECI, Ekinops, Fiberhome, Fujitsu, Huawei, Infinera, Inphi, NEC, Nokia, NTT Electronics (NEL), Padtec, Tejas, Xtera and ZTE.

Deliverables include Excel files with complete data sets, PowerPoint summaries and Cignal AI’s Active Insight news reporting. Cignal AI clients with an active subscription may access this material.

About Cignal AI

Cignal AI provides active and insightful market research for the networking component and equipment market and the market’s end customers. Our work blends expertise from a variety of disciplines to create a uniquely informed perspective on the evolution of networking communications.

Contact Us/Purchase Report

Sales: [email protected]

Web: Contact us