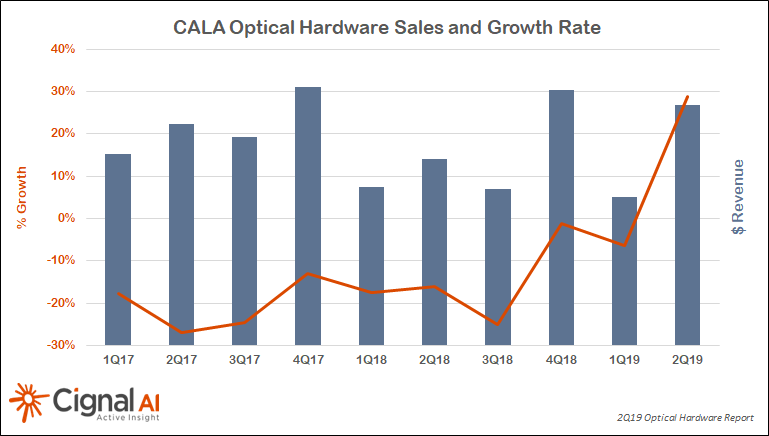

After Two Years of Decline, CALA Rebounds

BOSTON (August 20, 2019) – Optical hardware spending grew in every region and for every business segment during 2Q19, according to the most recent Optical Hardware Report from research firm Cignal AI. Huawei retained top market share worldwide and held steady despite a slowdown in China and increasing competitive and political pressures.

This quarter marked a turnaround for CALA, reversing multiple quarters of decline with a YoY surge of 30%. EMEA also grew with expansion across all product segments. Overall growth in North America was minor and would have been negative again if not for an enormous SLTE revenue increase this quarter. Finally, the rapid expansion in Japan for the past few quarters settled down to a more moderate pace with Ciena, NEC, and Huawei as the prime beneficiaries.

“Huawei managed to retain market share in what is typically its strongest quarter of the year,” said Scott Wilkinson, Lead Analyst at Cignal AI. “Despite the export ban of many optical components and the reports of competitive wins against Huawei in EMEA and APAC, Huawei market share remained steady.”

Cignal AI’s Optical Hardware Report is issued each quarter and examines optical equipment revenue across all regions and equipment types. The analysis is based on financial results, independent research, and guidance from individual equipment companies. Forecasts are based on overall spending trends for equipment types within the regions.

Additional Key Findings in 2Q19 Optical Hardware Report Include:

- WDM Long Haul Spending Up – Long haul spending recovered in every region except Japan, as compact modular equipment and new high-speed coherent optics impact investments.

- WDM Metro Declines in North America But Grows in All Other Regions – Factors contributing to the NA decline are the lower price per bit of new high-speed optics and competing priorities like the 5G rollout.

- SONET/SDH Hangs On – Growth in APAC and EMEA offset SONET/SDH’s ongoing decline in NA. This growth comes from expansions and upgrades to existing networks; there are no new builds.

- China’s Growth Slows — Growth in China appears dramatic due to the ZTE shutdown and the absence of revenue a year ago. Excluding ZTE’s results, growth slowed.

- Coherent Optic Shipments Tracking to Reach Nearly 1 Million 100G Equivalent Ports in 2019 – This represents a 40% increase in bandwidth over 2018.

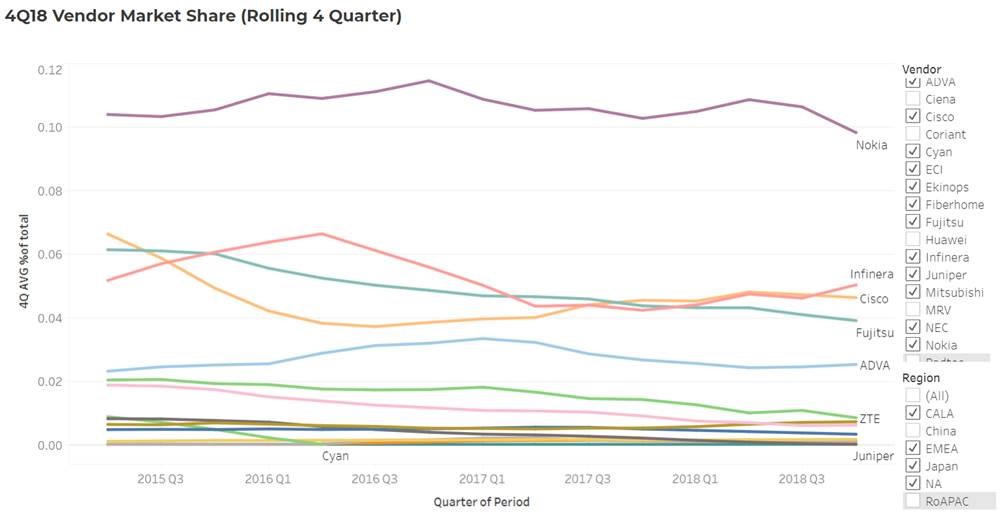

Interactive Optical Hardware Market Share Tracker

Cignal AI’s interactive Optical Hardware Market Share Tracker is available to clients of the Optical Hardware Report and provides quarterly up-to-date market data for real-time visibility on individual vendors’ results as they are released. Users can manipulate data online and see information in a variety of useful ways.

About the Optical Hardware Report

The Cignal AI Optical Hardware Report is published quarterly and includes market share and forecasts for optical transport hardware used in optical networks worldwide. In addition to the interactive tracker, analysis includes a detailed Excel database as well as PDF and PowerPoint summaries. Subscribers to the Optical Hardware Report also have access to Active Insight, Cignal AI’s real-time news service on current market events.

The report examines revenue for metro WDM, long-haul WDM and submarine (SLTE) equipment in six global regions and includes detailed port shipments by speed. Vendors in the report include Adtran, ADVA, Ciena, Cisco, ECI, Ekinops, Fiberhome, Fujitsu, Huawei, Infinera, Mitsubishi Electric, NEC, Nokia, Padtec, Tejas, Xtera, and ZTE.

A full report description, as well as articles and presentations, are available on the Cignal AI website.

About Cignal AI

Cignal AI provides active and insightful market research for the networking component and equipment market and the market’s end customers. Our work blends expertise from a variety of disciplines to create a uniquely informed perspective on the evolution of networking communications.

Contact Us/Purchase Report

Sales: [email protected]

Web: Contact us