Quarterly Optical Hardware Report Details Record Shipments of 100G Coherent Ports and North American Market Share Growth for Ciena and Cisco

BOSTON (August 21st, 2017) – Despite concerns from component makers, China’s optical hardware market continues to grow, according to the second quarter Optical Hardware Report from Cignal AI, a networking component and equipment market research firm. The report also provides insights on increasing demand for optical equipment in North America and India, resulting from a shift to metro WDM. Conversely, the report details declines in spending across the EMEA region.

“Demand for optical hardware in China is not slowing down, and equipment vendors are universally providing positive guidance for North America during the second half of the year,” said Andrew Schmitt, lead analyst for Cignal AI. “Operators around the world are shifting spending from long haul to metro WDM, though this shift is materializing into gains for only a few vendors.”

The Optical Hardware Report is issued quarterly and examines optical equipment revenue across all regions and equipment types, including shipment information and guidance from individual equipment companies. Forecasts are based on spending trends in each region and the equipment types within those regions.

Key report findings include:

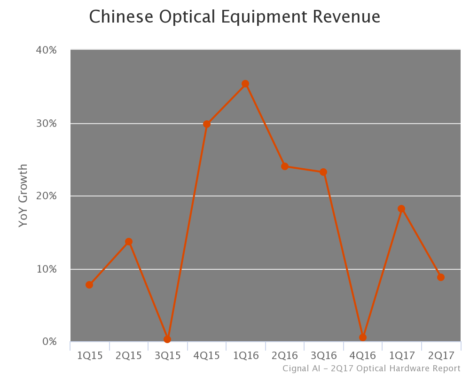

- Optical revenue in China is up 13 percent for the first half of 2017 as compared to the same period in 2016. The weak demand reported by component makers is a result of an ongoing inventory correction (primarily at Huawei), rather than a signal of weak end market demand.

- Huawei and ZTE both reported record shipments of 100G coherent ports in China during the quarter. The companies also showed strong revenue performance in the region.

- North American spending increased quarter-over-quarter. Consistent with earlier Cignal AI forecasts, North America is experiencing a shift in spending from long haul to metro WDM. Ciena and Cisco are the primary beneficiaries of the double-digit year-over-year growth in NA metro WDM. Both companies grew market share, and Ciena’s North American optical equipment revenue increased by 21 percent year-over-year.

- Outside of China and Japan, the rest of the Asia Pacific (ROAPAC) countries experienced 20 percent year-over-year growth. This region’s growth was particularly fueled by India’s Reliance Jio, which is purchasing substantial amounts of equipment from Ciena and Nokia as part of an aggressive 4G LTE expansion in the country.

- EMEA revenue dropped substantially, stemming from sharp declines in spending in the long haul WDM and submarine systems markets. Metro WDM spending remained flat year-over-year.

- Growth in metro WDM spending is creating greater demand for higher speed coherent ports, which are evolving from 200G to speeds as high as 400G later this year.

About the Optical Hardware Report

The Cignal AI Optical Hardware report includes market share and forecasts for optical transport hardware used in optical networks worldwide. Deliverables include an Excel database and PowerPoint summaries, plus our continuously published real-time news briefs, Active Insight. The report analyzes and quantifies revenue for metro WDM, long haul WDM and submarine (SLTE) equipment in six global regions, and includes detailed port shipments by speed. Vendors examined include Adtran, ADVA Optical Networking, Ciena, Cisco, Coriant, ECI Telecom, Ekinops, Fiberhome, Fujitsu, Huawei, Infinera, Juniper (BTI Systems), NEC, Nokia, Padtec, TE Connectivity, Xtera and ZTE.

Full report details, as well as free articles and presentations, are available to users who register for a free account on the Cignal AI website.

About Cignal AI

Cignal AI provides active and insightful market research for the networking component and equipment market and the market’s end customers. Our work blends expertise from a variety of disciplines to create a uniquely informed perspective on the evolution of networking communications.

Contact Us/Purchase Report

Sales: [email protected]

Web: Contact us