Boston, Massachusetts (28 February 2017)- Research firm Cignal AI released updated market share analysis from its quarterly Optical Hardware report. The Optical Hardware report summarizes optical equipment revenue results for the full year of 2016 and precedes a full release of the report with updated forecasts reflecting most recent data.

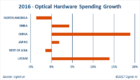

Global spending on optical network equipment (SONET/SDH, WDM, and Submarine LTE) increased in all global regions except North America.

“Next year should be much better in North America as operators who were waiting for the latest Metro WDM coherent solutions can now get them from several vendors,” says Andrew Schmitt, Lead Analyst for Cignal AI.

“Dedicated DCI hardware solutions with this technology are becoming the platform of choice, not only for Cloud and Colo customers but also for Cable MSOs and traditional Incumbents like AT&T and NTT.”

Also, Cignal AI believes China will surprise skeptics in 2017. “Forecasts of Chinese hardware vendors are aligned, and we think the boom in Chinese 100G deployments has room to still run farther. A realignment is underway in the supply chain that is sending mixed signals, but end demand is still growing.”

Optical Hardware Report Highlights

- Nokia and ADVA were the only vendors to record significant gains in North America during a challenging 2016. Growth in Cloud and Colo spending failed to offset decreases in Incumbent capex.

- Chinese spending jumped 19% in 2016 as coherent 100G port deployments doubled YoY, with yet more growth anticipated in 2017.

- Outside of China, Ciena and Nokia outperformed peers by leveraging leading edge 200G technology and tightly integrated supply chains.

- ADVA enjoyed a wave of Cloud and Colo spending, but now must face the uncertain revenue cycles characteristic of these customers, as also must its principal 100G supplier, Acacia.

- Infinera is scrambling to complete a critical product cycle while Fujitsu and Coriant navigate product and market transitions.

About the Optical Hardware Report

The Cignal AI Optical Hardware report includes market share and forecasts for optical transport hardware used in fiber optic networks worldwide. Deliverables include traditional Excel database and Powerpoint summaries, plus our continuously published real-time news briefs, Active Insight.

The report analyzes and quantifies revenue and optical ports for metro WDM, long haul WDM, and submarine (SLTE) equipment in six global regions. Vendors examined include Adtran, ADVA Optical Networking, Ciena, Cisco, Coriant, ECI Telecom, Ekinops, Fiberhome, Fujitsu, Huawei, Infinera, Juniper (BTI Systems), NEC, Nokia, Padtec, TE Connectivity, Xtera, and ZTE.

Full report details, as well as articles and presentations, are available to users who register for a free account on the Cignal AI website.

About Cignal AI

Cignal AI provides active and insightful market research for the networking component and equipment market and the market’s end customers. Our work blends expertise from a variety of disciplines to create a uniquely informed perspective on the evolution of networking communications.

Contact Us/Purchase Report

Sales: [email protected]

Web: Contact us