1Q25 Transport Hardware & Markets Report

The Optical and Routing markets show signs of recovery, and tariffs aren’t yet affecting business.

1Q25 Preliminary Transport Hardware & Markets Report

The Optical and Routing markets show signs of recovery, and tariffs aren’t yet affecting business.

4Q24 Transport Hardware & Markets Report

Carrier caution has resulted in underinvestment, and networks are now running “hot” enough to require upgrades and expansion.

4Q24 Preliminary Transport Hardware & Markets Report

Carrier caution has resulted in underinvestment, and networks are now running “hot” enough to require upgrades and expansion.

3Q24 Transport Hardware & Markets Report

Optical spending by Cloud & Colo operators grew 7% worldwide, while spending by Service Providers declined -17%.

3Q24 Preliminary Transport Hardware & Markets Report

Optical sales fall -14%, but are buffered by strong sales to Cloud and Colo operators.

2Q24 Transport Hardware & Markets Report

Optical sales fall -18% as carrier inventories take longer to deplete than anticipated.

2Q24 Preliminary Transport Hardware & Markets Report

Optical sales fall -18% as carrier inventories take longer to deplete than anticipated.

1Q24 Transport Hardware & Markets Report

Ex-China, revenue drops as service provider spending continues to stall.

1Q24 Preliminary Transport Hardware & Markets Report

Ex-China, revenue drops as service provider spending continues to stall.

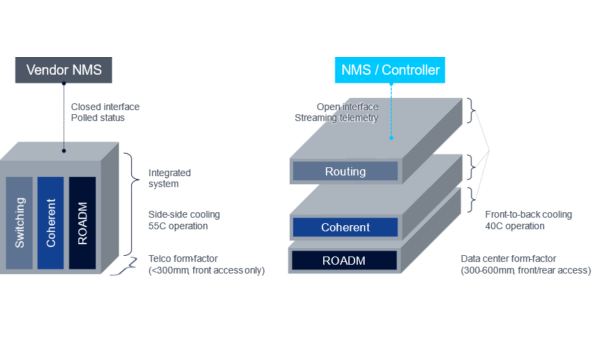

Compact Modular Hardware

This report provides historical information, industry context, and product examples of our classification of Compact Modular systems.

4Q23 Transport Hardware & Markets Report

Cloud Spending on Optical Transport Jumps 46% in 4Q23, Traditional Service Provider Spending Remains Weak

4Q23 Preliminary Transport Hardware & Markets Report

The market slides ex-china as service provider spending stalls.

3Q23 Transport Hardware & Markets Report

The optical market grew 4% – cloud operators continue to invest in transport and vendors are still shipping against large backlogs.

3Q23 Preliminary Transport Hardware & Markets Report

The optical market grew 4% – cloud operators continue to invest in transport and vendors are still shipping against large backlogs.

2Q23 Transport Hardware & Markets Report

Optical sales slowed due to inventory absorption and macroeconomic concerns, but routing sales continued to grow.

2Q23 Preliminary Transport Hardware & Markets Report

Supply chains loosen up and revenue ramps, some service providers express hesitation.

1Q23 Transport Hardware & Markets Report

North American Cloud operators were the growth engine for optical and packet transport sales.

1Q23 Preliminary Transport Hardware & Markets Report

Supply chains loosen up and revenue ramps, some service providers express hesitation.

4Q22 Transport Hardware & Markets Report

North American Cloud operators were the growth engine for optical and packet transport sales.