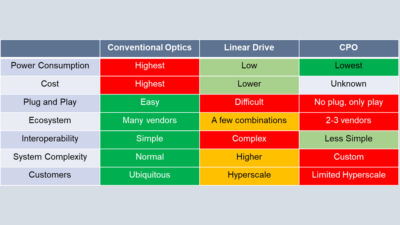

The Linear Drive Market Opportunity

Examines the benefits and challenges of Linear Drive and provides a preliminary assessment of its impact.

4Q22 Weekly Earnings – META GOOG AMZN GLW JNPR MTSI

Cloud capex outlook for 2023 summarized

ITW 2019 Observations

Cignal AI attended the 2019 International Telecoms Week (ITW) in Atlanta June 24-26. ITW is a trade show focused on the wholesale telecommunications market and is attended primarily by network…

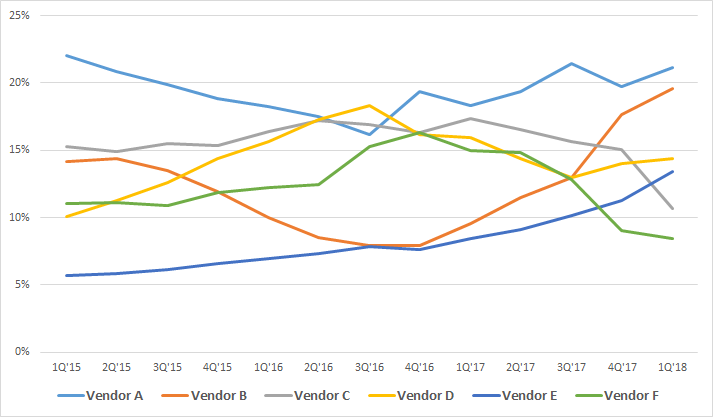

Cloud Spending on Optical Hardware – 1Q18 Update

In October 2017, Cignal AI analyzed the occurrence of a slowdown in spending by cloud & colo operators and quantified the magnitude of its impact (see Analysis: 1H17 Cloud and Colo Spending Slowdown).

Analysis: 1H17 Cloud and Colo Spending Slowdown

Cignal AI’s recent Optical Customer Markets Report discovered an unexpected weakness in 2017 optical transport equipment spending from cloud & colo operators (see Cignal AI Reports Unexpected Drop in Cloud and Colo Spending). This surprising trend was then further supported by public comments later made by Juniper and Applied Optoelectronics, prompting us to examine the situation in greater detail.

ADVA 2Q17

ADVA released its 2Q17 results on 7/20/2017, and our summary and analysis includes:

An overview of quarterly results

Cloudconnect update

Cloud and colo customer markets spending trends

MRV merger update and observations

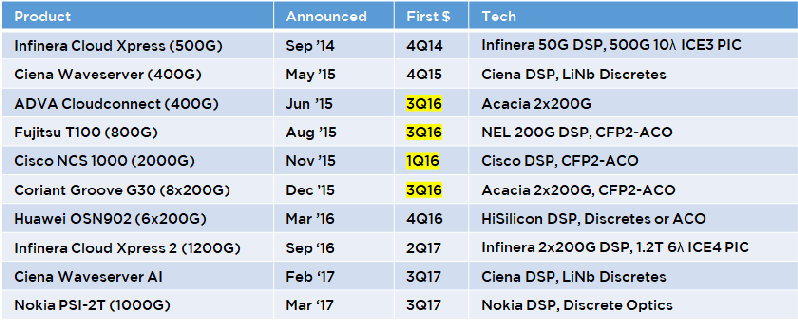

Investor Call – OFC 2017 Takeaways

Andrew Schmitt provided key OFC 2017 takeaways during an investor call hosted by Troy Jensen of Piper Jaffray.