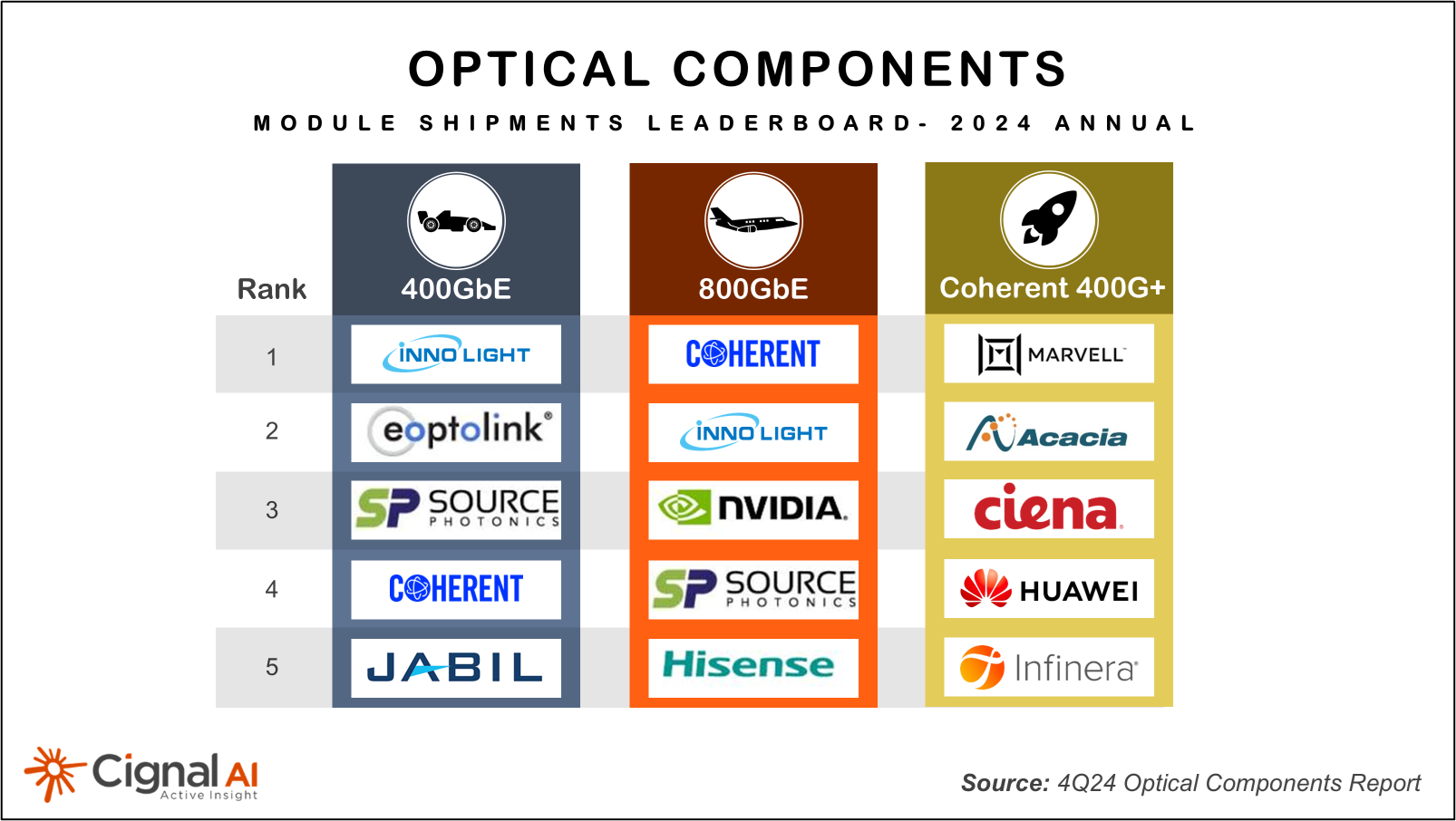

BOSTON (May 7, 2025) – After explosive growth in 2024, 800G Datacom optics for AI and general computing applications will be the fastest growing segment of the market in 2025, according to the latest Optical Components Report from research firm Cignal AI. 1.6T optics will enter volume production in select Nvidia and hyperscale applications, but they will remain at a volume under 1M units for the year.

Datacenter interconnect applications continue to consume record numbers of pluggable coherent modules. 400ZR and ZR+ accounted for the bulk of WDM bandwidth deployed in 2024, and the majority of modules were shipped by Marvell, Acacia, and Ciena.

“Hyperscale operator deployment of optics for connectivity both inside and between datacenter will continue to grow dramatically in 2025, although at reduced growth rates compared to those of 2024,” explained Scott Wilkinson, Lead Analyst for Optical Components at Cignal AI. “Operators will also begin a large-scale transition to 1.6T optics and coherent 800ZR modules in the second half of this year.”

Additional Findings from the 4Q24 Optical Component Report:

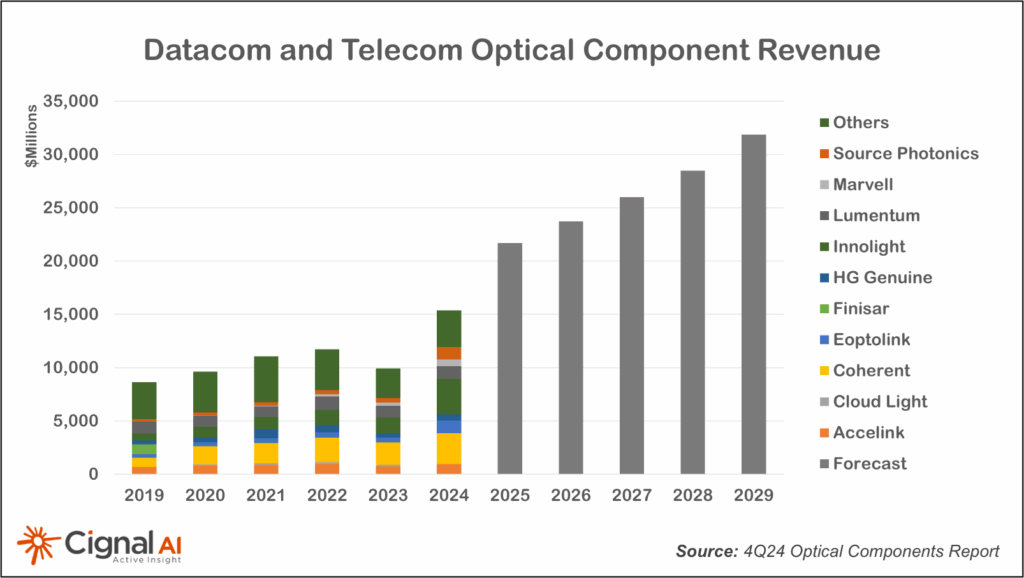

- The datacom optical component market will grow 60%+ to reach over $16B in revenue during 2025, based primarily on continued growth in 400G and 800G shipments.

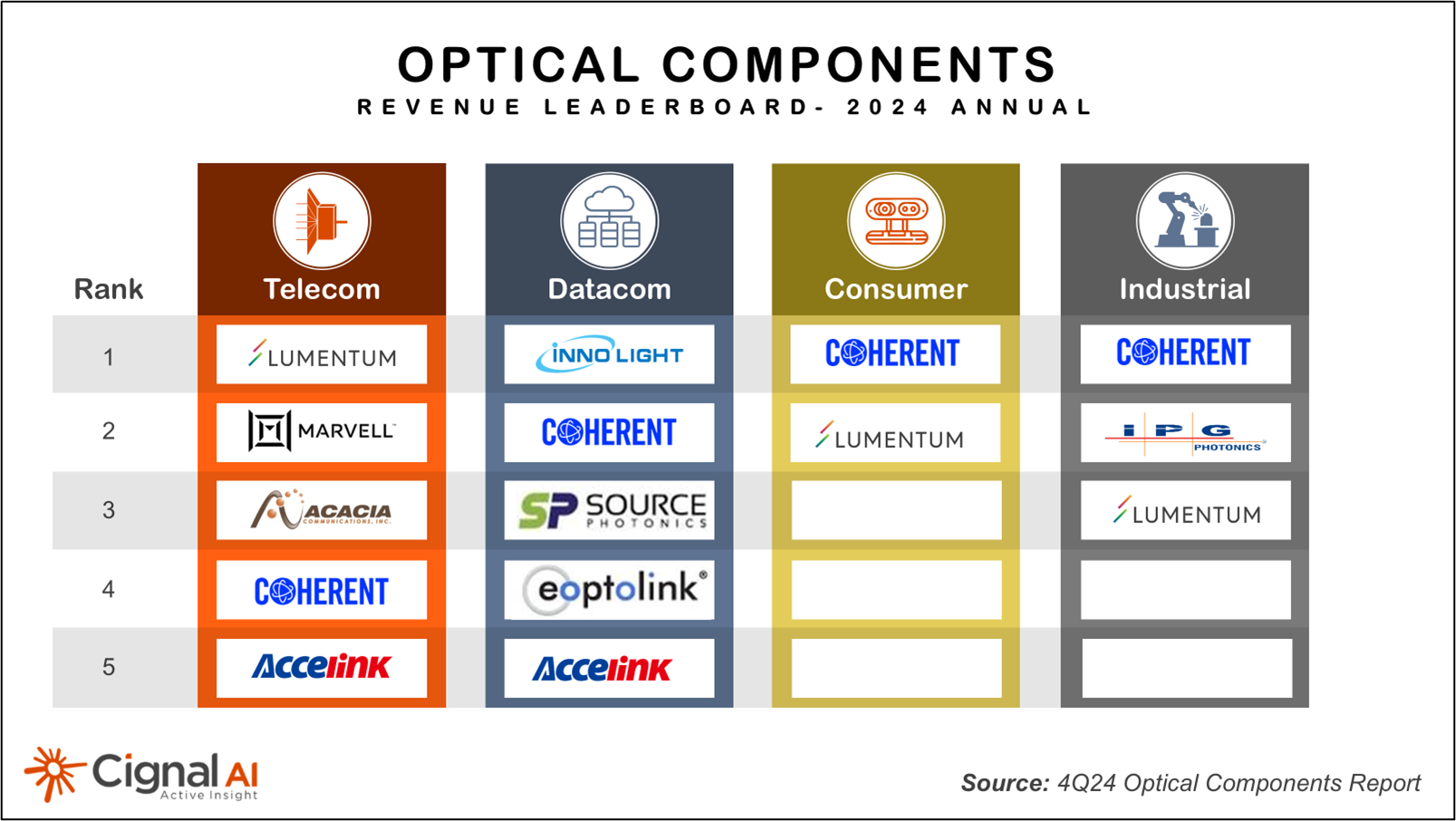

- Innolight, Coherent, and Eoptolink are the largest suppliers of Datacom modules, with Coherent, Broadcom, and Lumentum as key sources of critical optical components.

- The transition to 1.6T Datacom optics begins in 2025, but it will not affect the growth rate of 400/800G technology until 2026. Also, no material impact to pluggable shipments is expected in the next 3 years from co-packaged optics.

- Telecom component revenue will rebound in 2025, with continued growth from 400ZR coherent optics coupling with accelerating sales of the latest generations of WSS modules & amplifiers.

- Lumentum was the revenue leader for Telecom components in 2024, followed by 400ZR vendors Marvell and Acacia.

- No forecast adjustments have been made due to tariffs and trade uncertainty, but industry participants are notably pessimistic (see free Active Insight report).

2024 Revenue and Shipment Leaderboards

Live Presentation Available

Results from Cignal AI’s Optical Components Report are presented live each quarter by Lead Analyst Scott Wilkinson. Clients are welcome to attend today’s (May 7, 2025) presentation at 11AM or register to be notified when a replay and slide download is available.

About the Optical Component Report

Cignal AI’s Optical Components Report is published quarterly and provides revenue-based market share of company sales into four optical component markets: Datacom, Telecom, Industrial, and Consumer. The report also tracks detailed unit shipments and total market size of datacom and telecom components, including 400GbE/800GbE/1.6TbE datacom transceivers used for intra-datacenter applications, as well as 400ZR/800ZR pluggable and embedded coherent transceivers for telecom applications.

Five-year forecasts are provided for all revenue segments as well as detailed unit shipments. Data, including forecasts, are updated continuously as additional information becomes available and market events impact the industry outlook.

Companies included in the report are Acacia, Accelink, Adtran, ADVA, Applied Optoelectronics, Broadex, Ciena, Cisco, Coherent, Emcore, Eoptolink, Fiberhome, Finisar, Fujitsu, Furukawa Electric, HG Genuine, Huawei, Hisense Broadband, Infinera, Innolight, Inphi, Intel, IPG Photonics, Jabil, Lumentum, Marvell, Mitsubishi, Molex, NEC, Neophotonics, Nokia, OE Solutions, PacketLight, SONT Technology, Source Photonics, Sumitomo, Sumitomo Osaka Cement, and ZTE.

A full description of the report methodology, including an up-to-date listing of all product categories as well as reports and presentations, is available on the report page.

About Cignal AI

Cignal AI provides active and insightful market research for the networking component and equipment market and the market’s end customers. Our work blends expertise from a variety of disciplines to create a uniquely informed perspective on the evolution of networking communications.

Contact Us/Purchase Report

Sales: [email protected]

Web: Contact us