Cignal AI was pleased to be a presenter at the OIF’s sold out OIF 448Gbps Signaling for AI Workshop last week in Santa Clara, where some of the industry’s deep thinkers gathered to discuss the path forward to 488G signaling, which is a fundamental technology for advancing towards 3.2T optics.

To an outside observer, the workshop may have felt like stepping into the middle of a conversation that has been going on for a while. Most of the issues surrounding 448G signaling are well established, and the workshop provided an opportunity for researchers to present their latest tests and simulations for the variety of solutions proposed. Most agree that PAM4 will continue to be the signaling format of choice for optical channels. PAM6 is the consensus leader in the race to determine an optimal electrical channel, but there is still open debate in that area.

The hyperscaler keynotes all echoed the imperative for faster speeds now. The industry does not have the luxury of waiting 3-5 years between generations as AI drives interconnect demands higher every year. If and how this challenge can be met was the main focus of the workshop, and it will preoccupy the industry throughout 2025.

Background

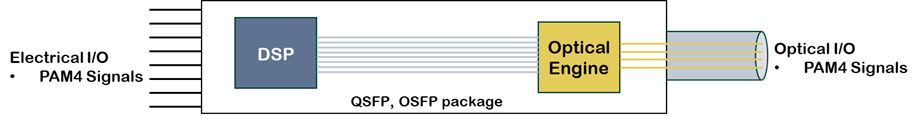

Electrical and optical signaling in datacenter optics is based on PAM4 and it has migrated from 50G to 100G to 200G over the last few years. The transitions have been generally orderly, with technological advancements in DSP speeds, optical modulator capabilities, and packaging progressing in a predictable way. However, the challenges are daunting as we approach 400Gbps per lane, especially in the electrical domain where 400G signals may not reach from the switch chips or GPUs to the optics.

| Module Speed | Electrical Speed | Optical Speed |

|---|---|---|

| 400GbE | 50Gbps x 8 | 100Gbps x 4 |

| 800GbE | 100Gbps x 8 | 100Gbps x 8 200Gbps x 4 (emerging) |

| 1.6TbE | 200Gbps x 8 | 200Gbps x 8 |

| 3.2TbE | Options: 400Gbps x 8 200Gbps x 16 | Options: 400Gbps x 8 200Gbps x 16 Coherent Lite |

Electrical and Optical signal speeds in datacenter optics

Workshop Observations

The Industry is coalescing around PAM6 signaling as the way to get 400Gbps electrical signals from chips to modules. As the number of amplitude levels increases, the baud rate (symbols/second) reduces, and signals can propagate further. PAM8 is also an option, but signal to noise ratio (SNR) becomes more challenging as the received eye openings are smaller. There were a few presentations positing that PAM4 may yet have legs, but PAM4 will require improved connector designs and other hardware improvements to operate at 224 Gbaud. Employing PAM6 at 150 Gbaud seems to be an ideal middle ground between the simplicity of PAM4 and the SNR issues of PAM8.

On the optical side, 224 GBaud PAM4 remains the modulation of choice. Though its signals will not go as far as current PAM4 (112GBaud) and may have difficulty reaching beyond the 2km FR specification, PAM4 works much better in the optical domain than in the electrical domain and is still a valid option at 400G. Note that OFC featured several demonstrations of 400G PAM4 optical transmission.

The industry would like to avoid electrical to optical data rate conversion between PAM6 and PAM4, as these gearboxes add power to modules. This could lead to PAM6 optical, but more likely the concerns will be glossed over as gearboxes are integrated into the DSPs. Gearboxing has a long history in datacenter optics and is currently in wide use for 400G (50Gbps to 100Gbps) and some 800G (100Gbps to 200Gbps) modules.

Co-packaged copper is increasingly looking like a requirement for 400G electrical connections, with copper pads directly on the chips connecting to flyover cables to reach the distances needed for both front and backplane connections. Backplanes made of cables rather than printed circuit boards may also be required.

The industry would like to continue to use pluggable optics on the faceplate, which adds more complexity to the design but allows more flexibility than options like CPO (see Cignal AI’s Active Insight Report Co-Packaged Optics: Market and Technology Update). 400Gbps PAM4 signaling will not work with existing OSFP designs, but engineers believe that can be solved eventually.

There are some other intriguing options being proposed, almost all in the electrical domain, to extend the life of PAM4. While the problems posed are difficult, there is a lot of work being done and a large market awaiting commercial solutions.

Demand is Real

The market for high speed opto-electronics is forecast to exceed $18 billion by 2028, according to forecasts in Cignal AI’s Optical Components Report. 400Gbps/lane optics will start to become part of that market around 2028/29, and they will take market share from all other speeds as soon as they are available. Component suppliers will go to extraordinary lengths not to miss out on that market.

Keynotes delivered by Meta, Google, Microsoft, and OpenAI emphasized that hyperscalers need the fastest speeds they can get, as soon as they can get them. While not all AI builds are the same and each hyperscaler presenter emphasized different requirements and deployments, all of these companies stressed that 400G signaling cannot get here fast enough.

The bigger question is whether hyperscalers will access proprietary solutions in lieu of waiting for an industry standard or MSA. Speakers were divided on this topic, but all seem open to the idea that a proprietary solution delivered significantly faster than a standard one would be considered – so long as there is a sufficient supply chain to support the millions of optics that the deployments require.

Increasing the Pace

In unstructured hallway discussions, attendees expressed concern that generational advances are moving too fast for vendors to get returns on their investment. However, this is a different time and a different market, with AI driving demands faster than ever and generously rewarding first movers. Take a look at the 400ZR market as an example: The first two suppliers offering products (Marvell and Acacia) still dominate that market. No one wants to miss out on a multi billion-dollar 448Gbps market, and if standards don’t move fast enough, vendors will advance on their own. An open question, of course, is whether the technology can actually move faster, but the market rewards will compel many to find out.

A parallel concern is the lack of a long tail in some of the emerging technologies. Earlier generations had long tails as the technology moved from larger operators to smaller ones. For example, 400GbE demand exploded due to AI, but it will continue to have a market in datacenters and enterprise networks for years to come. With 800GbE, such a long tail is less definitive, as 1.6TbE will be available before many customers need to migrate from 400GbE. The initial AI markets are large enough that everyone is chasing them, but the accelerated pace is not healthy long-term, especially when AI builds eventually slow down.

Alternative Options

Wider and slower is still an option, rather than narrow and fast. New connector technologies could allow electrical signals to remain at 200Gbps with more lanes, trading signal challenges for packaging challenges. This is the value proposition behind several startups working on technologies like CPO.

Co-packaged optics (CPO) were in the background for most of this workshop, as the focus was on traditional hardware architectures. However, CPO is one way to make the electrical issues much easier, as the distance between the chips and the optical engines is negligible. Some startups have even suggested using chip-to-chip signaling like UCIe rather than PAM4 for CPO, which would eliminate electrical PAM4 concerns altogether. However, the industry would prefer a solution that includes integrated PAM4 for now, as it allows more flexibility and a wider potential market beyond CPO for chips.

Linear Pluggable Optics (LPO) was also only mentioned peripherally during the workshop, as LPO will not work at 400G. However, there was note of some recent successes for LPO at 100G. For now, the size of the deployments is still below the 10% threshold that Cignal AI forecast for LPO in our Active Insight Report The Linear Drive Market Opportunity.

Conclusions

Despite significant challenges, the industry is in good hands with some very smart people putting significant effort into solving the challenges of 400G/lane and 3.2T optics. For now, the focus is on speeding up PAM signaling in the same (or similar) architectures, and it seems like the problems will eventually be solved. Open for discussion is the possibility that some disruptive technology could make this entire discussion moot (e.g., the earlier move to PAM4 in datacenter optics or coherent optics in long haul), but those are much harder to predict. We have a few years to figure it all out, as 200G/lane optics are just entering production, but expect to hear more about 400G/lane in 2026.