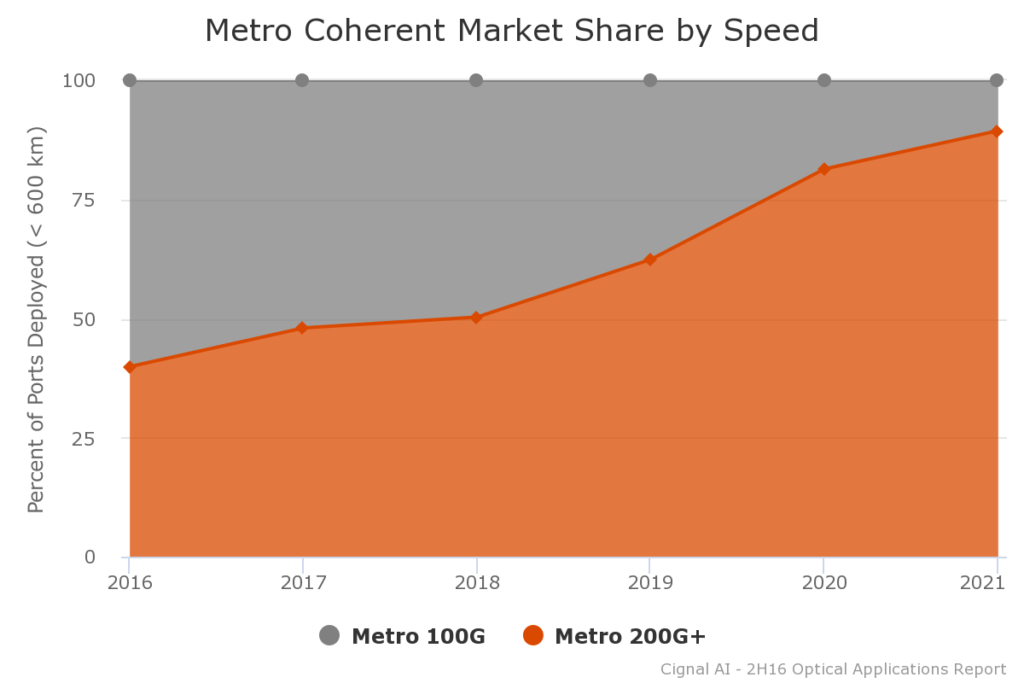

Half of Worldwide Metro Deployments Expected to be 200G in 2017, Fueled by Cloud/Colo Providers and Increased Interest in DCI by Incumbents

BOSTON (MAY 30, 2017) – There is a shift in the optical market this year as demand for 100G+ coherent WDM slows in China but grows in the West, according to the most recent Optical Applications Report from Cignal AI, a networking component and equipment market research firm. The report also projects that more than half of the WDM bandwidth deployed in 2017 will be coherent 200G, with the highest volume coming from compact data center interconnect (DCI) equipment used by cloud and colocation providers.

“After doubling in 2016, demand for 100G+ coherent WDM in China will slow this year. But our forecasts show that Western markets will offset this decline as cloud/colo providers, cable MSOs and traditional incumbents expand use of DCI products in their networks,” said Andrew Schmitt, lead analyst for Cignal AI. “These companies want to deploy the most cost-effective technology, which is why we expect that more than half of all metro bandwidth deployed around the world in 2017 will be in the 200G format.”

The Optical Applications Report is produced twice a year and provides forecasts for three key markets: 100G+ coherent WDM, compact DCI equipment and advanced optical switching. The current report examines market share through the second half of 2016, and key findings include:

100G+ Coherent WDM

- Demand in China doubled in 2016 and alone accounted for 55 percent of worldwide 100G coherent demand. Growth will drop considerably this year as the Chinese market transitions to DCO technology and expands deployment into the metro.

- During this transition, demand from Western markets will dominate in 2017, driving faster growth than the Chinese market for 100G ports due to mature 200G coherent technology and deployment of CFP2-ACO.

- Deployment of 200G and 400G will grow dramatically and account for half of all metro WDM bandwidth deployed worldwide in 2017.

- Excluding the Chinese market, 61 percent of 100G+ ports shipped in 2016 were by three companies: Infinera in the lead, followed closely by Ciena and Nokia.

Compact DCI

- The compact DCI market is expected to grow 65 percent per year through 2021.

- Infinera was the first to release a compact DCI product and remains the leader with well over half the market. However, Infinera faces significant pressure from Ciena, Cisco and Fujitsu, whose products are now in production and ramping aggressively.

- Customer loyalty in this market is scarce and demand comes mostly from agile cloud and colo providers, like Google and Microsoft, which can switch suppliers every 18 months to leverage the latest technology.

- While demand from cloud and colo providers is growing this market, there is also future interest from cable, wholesale and incumbent telco operators looking to adopt compact DCI for their networks.

Advanced Switching

- Advanced switching equipment is a $2 billion global market and it is expected to continue growing. Demand for these systems comes from incumbent providers such as Verizon, China Mobile and Telefonica, which are converging their transport networks with new systems that integrate wavelength, OTN and Ethernet switching into a single chassis.

- Ciena and Cisco are poised to reap the benefits of Verizon’s move to advanced switching; Nokia is the beneficiary of a similar move by Telefonica.

- Annual growth is expected to be 20 percent over the next five years.

About the Optical Applications Report

The Cignal AI Optical Applications Report includes revenue based market share and forecasts for DCI and advanced optical switching applications. It also includes detailed port-based vendor market share and forecasts for 100G shipments for edge, metro, and long-haul applications.

Report deliverables include Excel file with complete data set, PowerPoint summary and Optical Equipment Active Insight. Vendors examined include Acacia, ADVA Optical Networking, Ciena, Cisco, Coriant, ECI Telecom, Fiberhome, Fujitsu, Huawei, Infinera, NTT Electronics (NEL), Nokia and ZTE.

Full report details, as well as articles and presentations, are available to users who register for a free account on the Cignal AI website.

About Cignal AI

Cignal AI provides active and insightful market research for the networking component and equipment market and the market’s end customers. Our work blends expertise from a variety of disciplines to create a uniquely informed perspective on the evolution of networking communications.

Contact Us/Purchase Report

- Sales: [email protected]

- Web: Contact us