Equipment Demand Surges in a Challenging Supply Environment

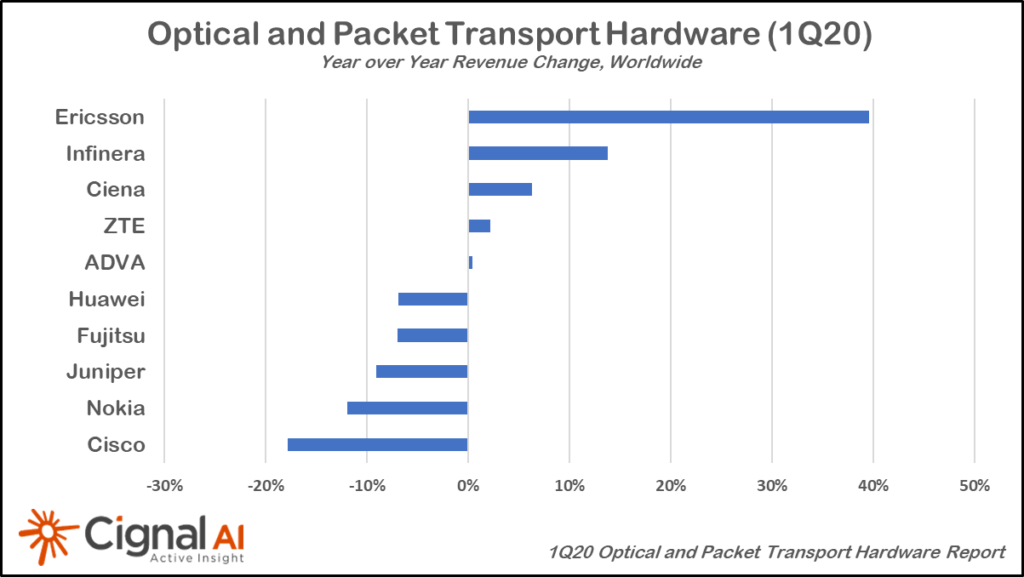

BOSTON (May 29, 2020) – The effects of COVID-19 simultaneously catalyzed demand for transport equipment and paralyzed supply chains worldwide during the first quarter of 2020. Cignal AI’s latest Transport Hardware Report results show that sales of optical and packet hardware varied dramatically by region, product category, and vendor.

During Q1 2020, network operators accelerated orders and installations of new equipment to deal with vastly increasing network demand. Not all orders were intended for immediate deployment; operators also wanted extra inventory readily available in uncertain times. However, disruption in the component supply and equipment manufacturing chain, as well as travel and shipping restrictions prevented equipment companies from satisfying demand. Consequently, individual equipment vendor results varied depending on the sourcing of components and manufacturing.

“Demand for equipment is solid right now, with one major operator reporting that 70% of its annual capex budget has already been spent,” said Scott Wilkinson, Lead Analyst at Cignal AI. “Operators are shifting demand forward to build capacity and inventory, and a decline in demand is likely to follow in the second half of the year.”

Cignal AI published a detailed Covid-19 Forecast Update report in April summarizing findings from network operators and the supply chain and made it freely available to the public.

The Transport Hardware Report is issued each quarter and examines optical and packet transport equipment revenue across all regions and equipment types. The analysis is based on financial results, guidance from individual equipment companies, and in-house research. Forecasts are based on expected spending trends for equipment types within the regions.

Additional 1Q20 Transport Hardware Report Findings:

- Most equipment vendors claimed a 5-10% reduction in sales due to COVID-19 operational issues. While demand sharply increased, the inability to get parts, manufacture, and deliver equipment reduced sales in all areas. This reduction was particularly true for sales of packet equipment by vendors such as Juniper Networks.

- Ciena, Cisco, Infinera, and Nokia all gained 20% or more in YoY optical transport sales in North America this quarter. Packet sales in the region were down significantly, with supply chain issues compounding a continued drop in demand from service providers.

- Transport equipment sales in China declined in the double digits as network operators and suppliers contended with increased network traffic demands and complex supply chain issues.

Transport Hardware Dashboard

Cignal AI’s real-time Transport Hardware Dashboard is available to clients of the Transport Hardware Report and provides up-to-date market data, including individual vendors’ results as they are released. Users can manipulate variables online and see information in a variety of useful ways, as well as download Excel files with up-to-date snapshots of market reporting.

About the Transport Hardware Report

The Cignal AI Transport Hardware Report is published quarterly and includes market share and forecasts for optical and packet transport hardware used in service provider networks worldwide. In addition to the real-time dashboard, analysis includes a detailed Excel database as well as PDF and PowerPoint summaries.

The report examines revenue for metro WDM, long-haul WDM and submarine (SLTE) optical equipment, and access, aggregation, edge, and core packet equipment in six global regions. Vendors in the report include Adtran, ADVA, Ciena, Cisco, ECI, Ekinops, Fiberhome, Fujitsu, Huawei, Infinera, Juniper, Mitsubishi Electric, NEC, Nokia, Padtec, Tejas, Xtera, ZTE, and others.

Subscribers to the Transport Hardware Report also have access to Active Insight, Cignal AI’s real-time news service on current market events. A full report description, as well as articles and presentations, are available on the Cignal AI website.

About Cignal AI

Cignal AI provides active and insightful market research for the networking component and equipment market and the market’s end customers. Our work blends expertise from a variety of disciplines to create a uniquely informed perspective on the evolution of networking communications.

Contact Us/Purchase ReportSales: [email protected]

Web: Contact us