BOSTON (January 7, 2025) – Total shipments of leading-edge datacom optical modules are projected to tally over $9 billion for 2024, according to the latest Optical Components Report from research firm Cignal AI. Unit shipments of 400G and 800G modules have grown nearly fourfold over the past 12 months and are expected to surpass 20 million for 2024.

“Optical interconnect for AI applications is scaling faster as shipments of GPUs and cluster sizes increase,” explained Scott Wilkinson, Lead Analyst for Optical Components at Cignal AI. “Operators are demanding the highest performance 800G optics and are poised to shift towards 200G/lane solutions in 2025.”

Additional 3Q24 Optical Component Report Findings:

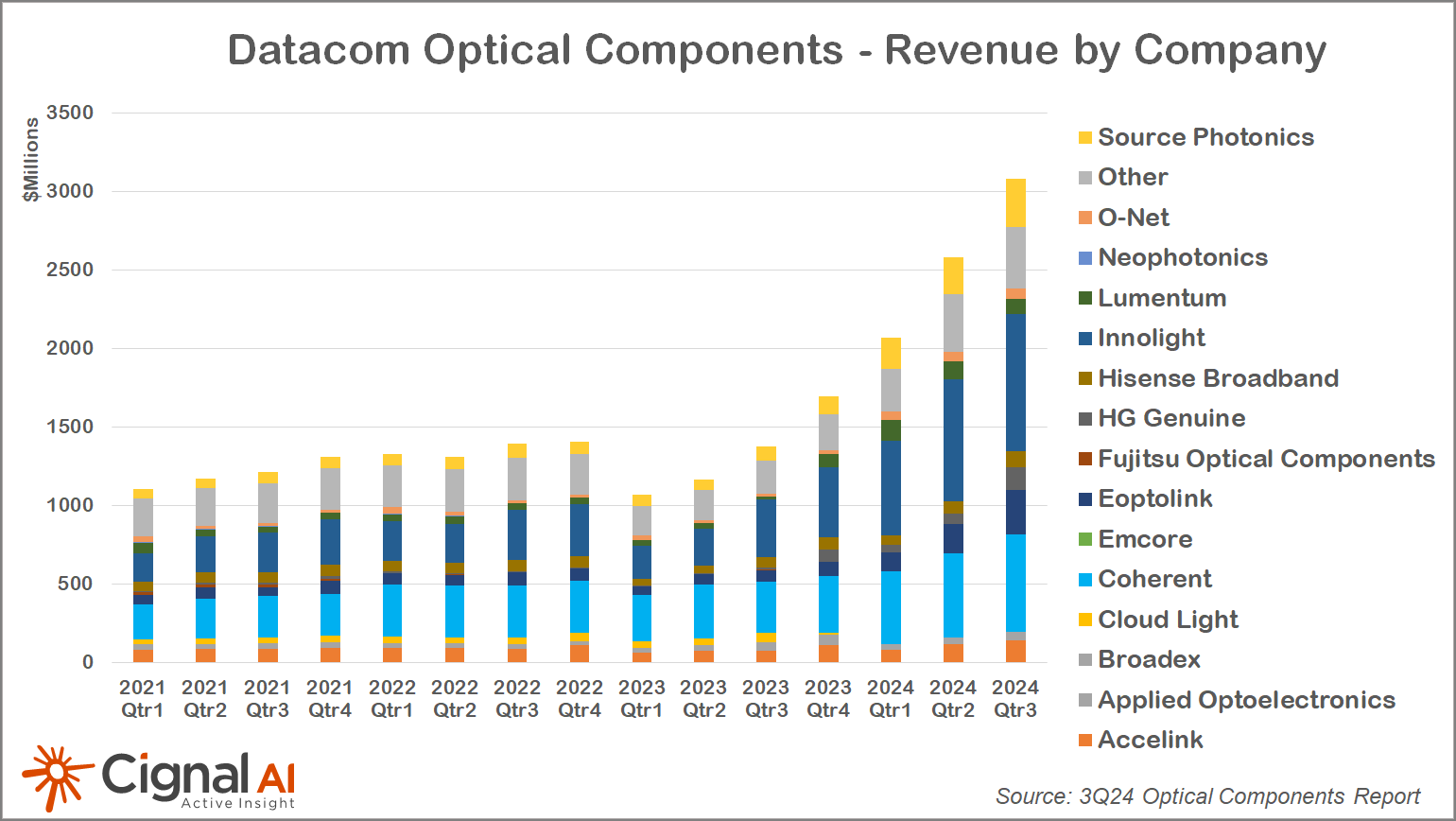

- The high-speed datacom optical market size is expected to expand from about $9 billion in 2024 to almost $12 billion in 2026 as 800G growth peaks and operators transition to 1.6T 200G/lane technology.

- 800GbE module growth slowed in 3Q24, although 400GbE shipments more than tripled YoY. Several of the largest 800GbE suppliers reported only modest growth or even declines in the quarter following massive shipment growth in 2Q24.

- The amount of Telecom bandwidth deployed surged 51% YoY in 3Q24 as service provider depleted inventories, thereby the lackluster growth of the prior two quarters.

- Total 400G coherent pluggable shipments more than doubled YoY as hyperscale operators continue adoption of this disruptive technology to address expanded datacenter builds.

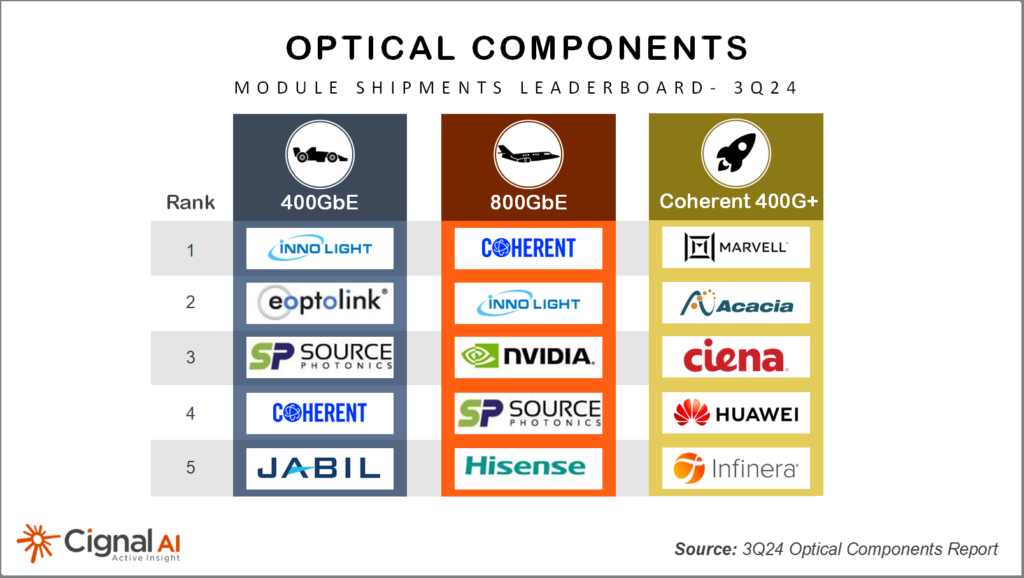

- Innolight continues to lead 400G datacom shipments, but Coherent took the top spot for 800G. Nvidia’s 800G solutions sourced from Fabrinet represent the third-largest source of modules at the highest production speed.

- Marvell and Acacia remain the largest suppliers of coherent ports, though Ciena is closing the gap as it nears a run rate of 10k 400ZR modules per quarter.

Live Presentation Available

Results from Cignal AI’s Optical Components Report are presented live each quarter by Lead Analyst Scott Wilkinson. Clients are welcome to download the slides and view a replay from December 19th at 11 AM ET.

About the Optical Components Report

Cignal AI’s Optical Components Report is published quarterly and provides revenue-based market share of company sales into four optical component markets: Datacom, Telecom, Industrial, and Consumer. The report also tracks detailed unit shipments and total market size of datacom and telecom components, including 400GbE/800GbE/1.6TbE datacom transceivers used for intra-datacenter applications, as well as 400ZR/800ZR pluggable and embedded coherent transceivers for telecom applications. Five-year forecasts are also provided for all revenue segments as well as detailed unit shipments.

Companies included in the report are Acacia, Accelink, Adtran, ADVA, Applied Optoelectronics, Broadex, Ciena, Cisco, Coherent, Emcore, Eoptolink, Fiberhome, Finisar, Fujitsu, Furukawa Electric, HG Genuine, Huawei, Hisense Broadband, Infinera, Innolight, Inphi, Intel, IPG Photonics, Jabil, Lumentum, Marvell, Mitsubishi, Molex, NEC, Neophotonics, Nokia, OE Solutions, PacketLight, SONT Technology, Source Photonics, Sumitomo, Sumitomo Osaka Cement, and ZTE.

A full description of the report methodology including an up-to-date listing of all product categories, as well as reports and presentations, are available on the report page.

About Cignal AI

Cignal AI provides active and insightful market research for the networking component and equipment market and the market’s end customers. Our work blends expertise from a variety of disciplines to create a uniquely informed perspective on the evolution of networking communications.

Purchase Report

Sales: [email protected]

Web: Contact us