BOSTON (December 19, 2024) – The WDM hardware market is experiencing a structural shift, with spending moving away from traditional systems and toward the deployment of pluggable coherent modules. According to Cignal AI’s 3Q24 Transport Hardware Report, global optical hardware spending declined by 17% YoY in Q3 2024. This drop was due to weaker spending from service providers which continue to draw down excess inventory. Spending by hyperscalers, however, grew for the fifth straight quarter.

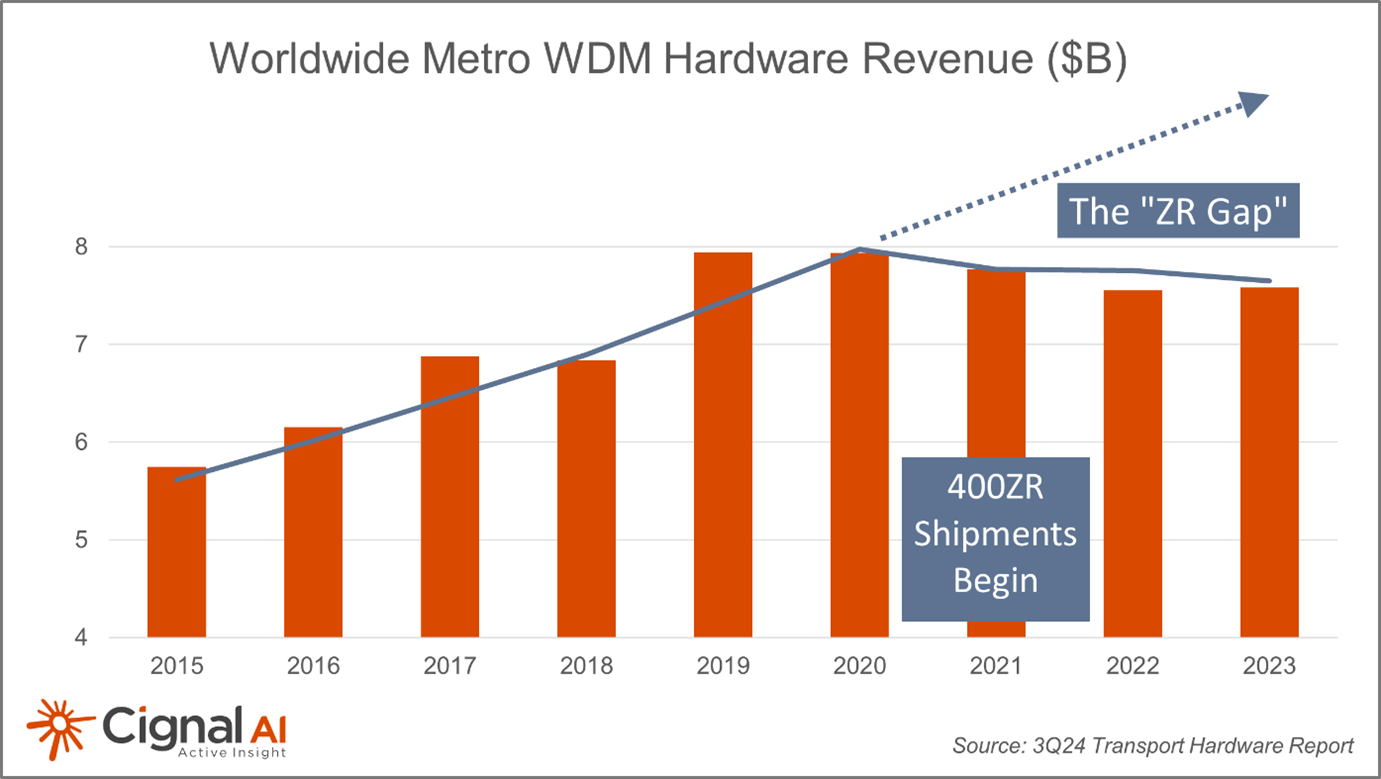

“The optical transport sector is grappling with multiple growth challenges, but the surge in Cloud capex offers a significant opportunity,” said Kyle Hollasch, Lead Analyst at Cignal AI. “Network operators are shifting their spending away from traditional metro optical transport systems toward 400ZR-based IP-over-DWDM solutions, upending historical spending patterns. Growth is now coming from long-haul WDM, which is essential for connecting the AI data centers where hyperscalers are investing tens of billions of dollars.”

Additional 3Q24 Transport Hardware Report Findings:

- Long Haul and Metro spending trends continue to diverge due to the impact of IP-over-DWDM. Long Haul hardware revenue has now surpassed Metro spending for the third consecutive quarter. This trend was first identified by Cignal AI in 2021 in our Active Insight presentation 400ZR IPoDWDM – Market Impact and Forecast.

- North American Optical Hardware revenue was nearly flat as inventories normalized and Cloud spending continued its upward trajectory. However, routing sales dropped to their lowest level since 2020.

- Optical Transport sales in China declined as long-haul buildouts to support the “East Data, West Compute” initiative were completed.

- A Telecom hardware supply chain recovery is underway as component companies reported improving results and noted that recent weakness is reversing. However, some of these gains are attributed to the growing sales of 400ZR pluggables, which do not contribute to optical hardware revenue.

Key Vendor Developments:

- Ciena’s WaveLogic 6e is now shipping, with 1.6Tb/s trials and deployments announced. The company also shipped a record number of 400ZR pluggables in the quarter.

- Infinera secured a second hyperscaler for its new line system and has 400G ICE-X orders from two Tier 1 customers. Additionally, Infinera officially announced its first customer win for the 1.2Tb/s ICE7, though no field trials were disclosed.

- Nokia’s CEO stated that traditional service providers are no longer a significant growth market, and that the opportunity is in data centers. The company also continued its stream of customer announcements for the 1.2Tb/s PSE-6s, which shipped several hundred units in the quarter.

- A real time performance benchmark of coherent trials and deployments is freely available at the Coherent Trials and Deployments Tracker.

Live Presentation Available

Results from Cignal AI’s Transport Hardware Report are presented live each quarter by Lead Analyst Kyle Hollasch. Clients are welcome to download the slides and view a replay from Tuesday, December 17th.

About the Transport Hardware Report

Cignal AI’s Transport Hardware & Markets Report is issued each quarter and examines optical and packet transport equipment revenue across all regions, customers, and equipment types. The initial analysis is based on financial results, independent research, and guidance from individual equipment companies. Hardware forecasts are reviewed and updated in the following weeks, along with spending trends by operator type.

The report examines revenue for metro WDM, long-haul WDM and submarine (SLTE) optical equipment, and access, aggregation, edge, and core routing equipment in six global regions. It also tracks equipment spending by end-customer market type, including traditional service provider, cloud/hyperscale, and enterprise/government network operators. Key market segments such as Compact Modular and Packet-OTN equipment as well as shipments of ROADMs are also included.

Vendors in the report include Adtran, Alaxala, Ciena, Cisco, Ekinops, Fiberhome, Fujitsu, Huawei, Infinera, Juniper, Mitsubishi Electric, NEC, Nokia, Packetlight, Padtec, Ribbon, Smartoptics, Tejas, ZTE as well as other vendors. A full report description, articles, and presentations are available on the Cignal AI website.

About Cignal AI

Cignal AI provides active and insightful market research for the networking component and equipment market and the market’s end customers. Our work blends expertise from a variety of disciplines to create a uniquely informed perspective on the evolution of networking communications.