Record pluggable coherent shipments are not enough to reverse Telecom revenue weakness

BOSTON (September 10, 2024) – Datacom component revenue surged to nearly $2.5B in 2Q24 as Cloud operators rushed to support AI networking infrastructure, according to the latest Optical Components Report from research firm Cignal AI. For the first time, unit shipments of 400/800GbE Datacom optics topped 5 million in a quarter.

“400GbE and 800GbE shipments reached record levels this quarter with demand that will continue to build through the rest of the year,” said Scott Wilkinson, Lead Analyst for Optical Components at Cignal AI. “400ZR and the recently introduced 800ZR were the only bright spot in an overall down market for Telecom optical components, although rising demand for advanced line system components sets the stage for a reversal.”

Additional 2Q24 Optical Component Report Findings:

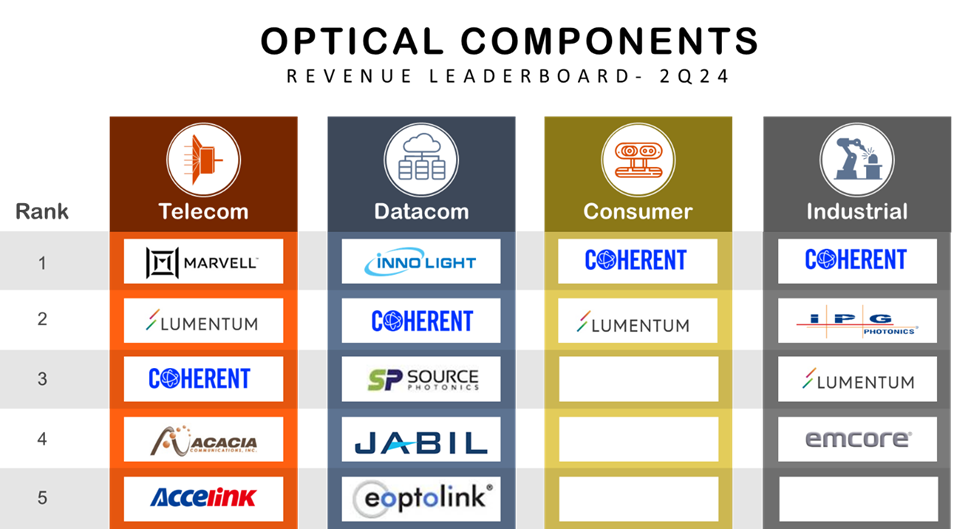

- Spending on Datacom optical components in 2Q24 doubled YoY from record demand to meet AI deployments. Innolight, Coherent, and Source Photonics are the revenue leaders Datacom revenue.

- 800GbE module demand continues to grow due to the superior cost and performance of 100Gbps/lane technology, with shipments growing 50% QoQ. Innolight is the largest supplier of these modules.

- The 400ZR/ZR+ market, despite its already large size, continues to scale as shipments of pluggable coherent jumped 70% YoY following two quarters of slower growth. Marvell and Acacia remain the unit shipment leaders.

- The first 800ZR pluggable modules shipped this quarter and more vendors are expected to join this market by the end of the year. Cignal AI forecasts the 800ZR market to be less than 400ZR at maturity, as discussed during its recent 800ZR webinar with Google, Ciena, and Marvell.

- Despite record shipments of 400ZR/ZR+ modules, telecom bandwidth growth remains well below the historical trend of 35-40%/year. Service provider purchases of traditional embedded coherent WDM ports remain tepid.

- Lumentum provided positive commentary on future demand for advanced line system components and hinted at a coming reversal in Telecom component demand; a sentiment echoed by Ciena.

Live Presentation Available

Results from Cignal AI’s Optical Components Report are presented live each quarter by Lead Analyst Scott Wilkinson. Clients are welcome to register for a presentation on September 19th at 11 AM ET.

About the Optical Component Report

Cignal AI’s Optical Components Report is published quarterly and provides revenue-based market share of company sales into four optical component markets – Datacom, Telecom, Industrial, and Consumer. The report also tracks detailed unit shipments and total market size of Datacom and Telecom components, including 400GbE/800GbE/1.6TbE Datacom transceivers used for intra-datacenter applications as well as pluggable and embedded coherent transceivers for Telecom applications. Five-year forecasts are also provided for all revenue segments as well as unit shipments.

Companies included in the report are Acacia, Accelink, Adtran, ADVA, Applied Optoelectronics, Broadex, Ciena, Cisco, Coherent, Emcore, Eoptolink, Fiberhome, Finisar, Fujitsu, Furukawa Electric, HG Genuine, Huawei, Hisense Broadband, Infinera, Innolight, Inphi, Intel, IPG Photonics, Jabil, Lumentum, Marvell, Mitsubishi, Molex, NEC, Neophotonics, Nokia, OE Solutions, PacketLight, SONT Technology, Source Photonics, Sumitomo, Sumitomo Osaka Cement, and ZTE.

A full description of the report methodology including an up-to-date listing of all product categories, as well as reports and presentations, are available on the report page.

About Cignal AI

Cignal AI provides active and insightful market research for the networking component and equipment market and the market’s end customers. Our work blends expertise from a variety of disciplines to create a uniquely informed perspective on the evolution of networking communications.

Contact Us/Purchase ReportSales: [email protected]

Web: Contact us