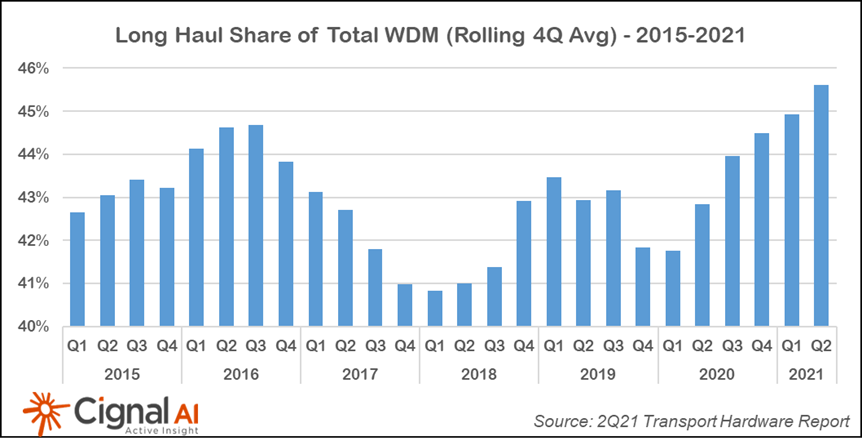

Long-Haul WDM Spending Mix Reaches Record Levels

BOSTON (September 8, 2021) – Worldwide spending on network transport equipment declined 5% in the second quarter of 2021, according to the most recent Transport Hardware Report from research firm Cignal AI. North American results were weak YoY due to cyclical Covid influences in 2020. Still, NA operators are set to grow spending aggressively in the second half of the year. Chinese network operator spending collapsed over 20% in 2Q21 as 5G capex paused and supply chain challenges worsened.

“Despite current semiconductor supply chain issues, North American spending should accelerate in the second half of 2021 as operators purchase additional high-performance long-haul WDM coherent equipment,” said Kyle Hollasch, Lead Analyst for Transport Hardware at Cignal AI. “Long Haul line systems capable of supporting wider and variable channel spacing, higher degree counts, and improved add/drop capabilities provide compelling reasons to make investments now.”

Additional 2Q21 Transport Hardware Report Findings:

- The spending mix between long-haul and metro WDM reached a record level following 5 quarters of investment in advanced coherent and line system technology. Carriers may be deferring metro expenditures considering the imminent availability of transport system upgrades utilizing 400G coherent pluggables.

- Chinese optical and packet hardware spending collapsed, resulting in the largest single quarterly decline on record and the first instance of consecutive quarters with YoY declines.

- Sales of optical hardware in EMEA were up significantly YoY as the region continues to produce steady single-digit growth. Despite strategic wins by Nokia and observations of increasing replacement activity from Ciena, Huawei’s footprint in EMEA shows no noticeable impact from geopolitical factors.

- North American packet transport sales were up slightly, with market leader Cisco realizing gains in Core as its 8000 series routers ramp.

- Component shortages weighed on smaller equipment manufacturers as constrained global semiconductor production increased lead times. ADVA and Infinera quantified the effect on sales (10% and 6% of revenue, respectively), though larger vendors reported minimal impact on their sales. Vendors do not anticipate resolution of these issues until 2022.

Upcoming Live Presentation

Results from Cignal AI’s Transport Hardware Report are presented live each quarter by Lead Analyst Kyle Hollasch. Clients are welcome to register to attend the next presentation on September 14th @ 11 AM ET, or can simply register and be notified when a replay is available and PowerPoint slides can be downloaded.

About the Transport Hardware Report

Cignal AI’s Transport Hardware Report is issued each quarter and examines optical and packet transport equipment revenue across all regions and equipment types. The initial analysis is based on financial results, independent research, and guidance from individual equipment companies. Hardware forecasts are reviewed and updated in the following weeks, along with spending trends by operator type.

The Transport Hardware Report examines revenue for metro WDM, long-haul WDM and submarine (SLTE) optical equipment, and access, aggregation, edge, and core packet equipment in six global regions. Vendors in the report include Adtran, ADVA, Alaxala, Ciena, Cisco, Ekinops, Fiberhome, Fujitsu, Huawei, Infinera, Juniper, Mitsubishi Electric, NEC, Nokia, Padtec, Ribbon, Tejas, Xtera, and ZTE. A full report description, as well as articles and presentations, are available on the Cignal AI website.

About Cignal AI

Cignal AI provides active and insightful market research for the networking component and equipment market and the market’s end customers. Our work blends expertise from a variety of disciplines to create a uniquely informed perspective on the evolution of networking communications.

Contact Us/Purchase ReportSales: [email protected]

Web: Contact us