European Capex Offsets North American Weakness

BOSTON (November 19, 2020) – European operators resumed purchases of optical and packet transport hardware in 3Q20 as COVID-related supply chain and operational delays eased, according to the most recent Transport Hardware Report from research firm Cignal AI. At the same time, North American spending weakness spread to the optical hardware segment as the region’s operators paused capex after aggressive deployments in the first half of the year.

“EMEA’s packet and optical transport sales growth was bolstered by sales deferred from Q2 and raised the market overall during the third quarter,” said Scott Wilkinson, Transport Hardware lead analyst at Cignal AI. “The outcome was different in North America, where sales were more frontloaded in the first two quarters than in EMEA, especially by the larger operators. NA annual CapEx budgets are largely exhausted, producing declining sales in the second half of the year for this region.”

Additional 3Q20 Transport Hardware Report Findings:

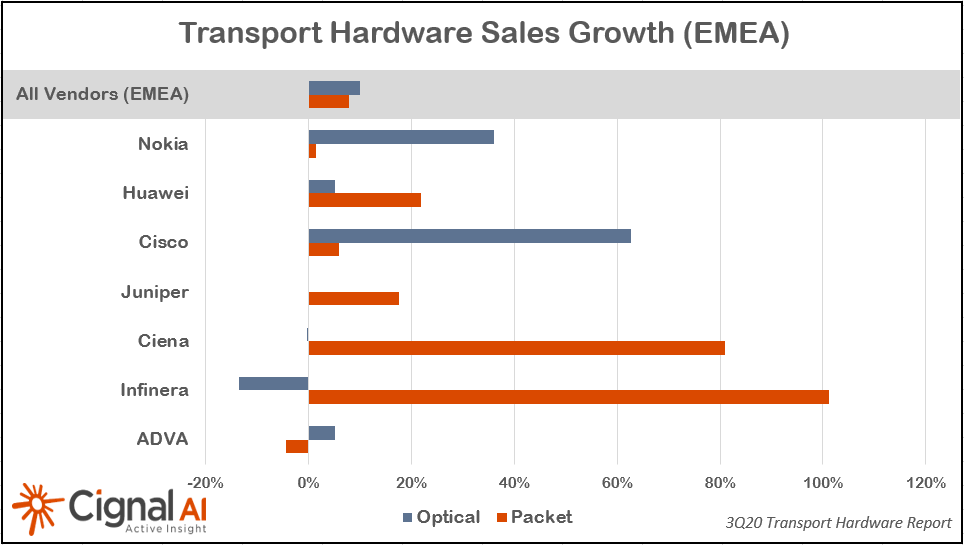

- Optical hardware spending grew by double-digits in EMEA, countering expectations of a flat-to-down quarter in optical spending. Nokia led the robust growth with a boost from sales deferred from Q2. Worldwide, optical hardware spending was up slightly.

- Packet transport hardware spending also rose in EMEA but declined worldwide. EMEA packet transport revenue for both Huawei and Juniper grew by more than 20% YoY as the two companies gained ground on market leaders Cisco and Nokia.

- North American optical and packet spending declined this quarter, as anticipated by vendors (Ciena, Cisco) with exposure to large network operators. Ciena continues to lead optical market share with slight YoY revenue growth, while Cisco maintains packet transport market leadership despite a sharp YoY revenue decline.

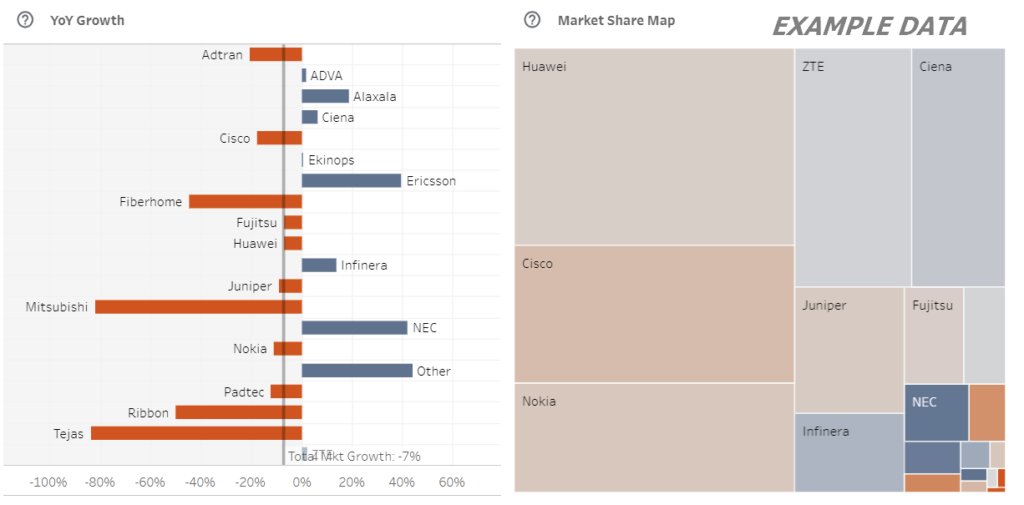

Real-Time Market Data

Cignal AI’s Transport Hardware Dashboard is available to subscription clients of the Transport Hardware Report. The Dashboard provides real-time market data featuring vendors’ results as they are released. Users are able to manipulate variables online to view information in a variety of useful ways, as well as download Excel files with current snapshots of market reporting.

About the Transport Hardware Report

Cignal AI’s Transport Hardware Report is issued each quarter and examines optical and packet transport equipment revenue across all regions and equipment types. The initial analysis is based on financial results, independent research, and guidance from individual equipment companies. Hardware forecasts are reviewed and updated in following weeks, along with spending trends by operator type. Clients can review a summary of quarterly results as well as access real-time dashboards and Excel downloads. Additionally, subscribers to the Transport Hardware Report have access to Active Insight, Cignal AI’s news service highlighting current market events.

The Transport Hardware Report examines revenue for metro WDM, long-haul WDM and submarine (SLTE) optical equipment, and access, aggregation, edge, and core packet equipment in six global regions. Vendors in the report include Adtran, ADVA, Alaxala, Ciena, Cisco, Ekinops, Fiberhome, Fujitsu, Huawei, Infinera, Juniper, Mitsubishi Electric, NEC, Nokia, Padtec, Ribbon, Tejas, Xtera, and ZTE. A full report description, as well as articles and presentations, are available on the Cignal AI website.

About Cignal AI

Cignal AI provides active and insightful market research for the networking component and equipment market and the market’s end customers. Our work blends expertise from a variety of disciplines to create a uniquely informed perspective on the evolution of networking communications.

Contact Us/Purchase ReportSales: [email protected]

Web: Contact us