COVID-19 Continued to Pressure Supply Chain

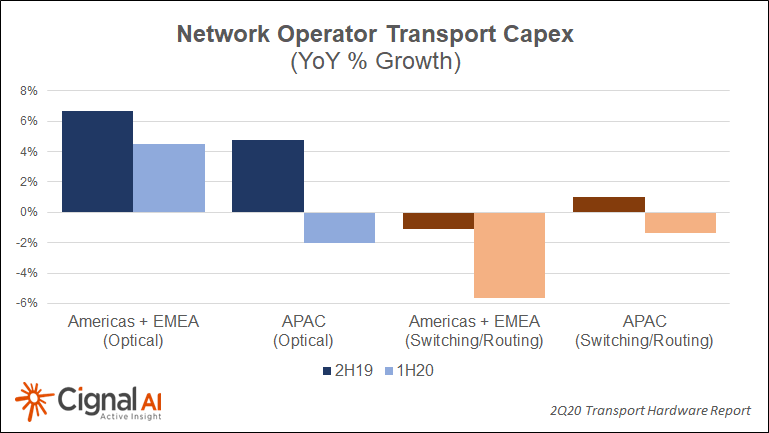

BOSTON (August 27, 2020) – Delayed order fulfillment due to COVID supply chain impact earlier this year was expected to spur sales growth in 2Q20, but instead the results were mixed, according to the most recent Transport Hardware Report from research firm Cignal AI. Forecasted growth in Q2 from sales pushed out from Q1 did not materialize, and network operators indicated that annual CapEx would not increase. As a result, spending on optical and switching & routing equipment will be flat to down in the second half of the year.

“COVID operational issues slowed deliveries and revenue recognition in the second quarter, although optical hardware sales increased in NA and EMEA due to high demand for inventory,” stated Cignal AI Lead Analyst Scott Wilkinson. “Growth is not expected to continue in the second half as carriers have pulled forward annual CapEx spending and networks are now able to cope with COVID-related surges.”

Some regions did shine in 2Q20. North American optical sales were up sharply YoY in both metro and long haul WDM, though the second half of the year is expected to be flat or down. Japan’s extraordinary growth in optical sales expanded to packet sales this quarter, with sales to both market segments up substantially YoY.

Cignal AI’s Transport Hardware Report is issued each quarter and examines optical and packet transport equipment revenue across all regions and equipment types. The analysis is based on financial results, independent research, and guidance from individual equipment companies. Forecasts are based on expected spending trends for equipment types within the regions.

Additional 2Q20 Transport Hardware Report Findings:

- In addition to COVID woes, RoAPAC continues to suffer from the CapEx limitations in India, and optical sales declined -20% for the quarter while packet sales also declined.

- China has overcome its COVID related issues and returned to optical and packet spending growth this quarter, with increasing growth forecasted for Q3.

- EMEA optical spending increased YoY but was weighed down by weak Nokia sales. Nokia predicts that Q3 sales increases will offset Q2 declines.

Real-Time Market Data

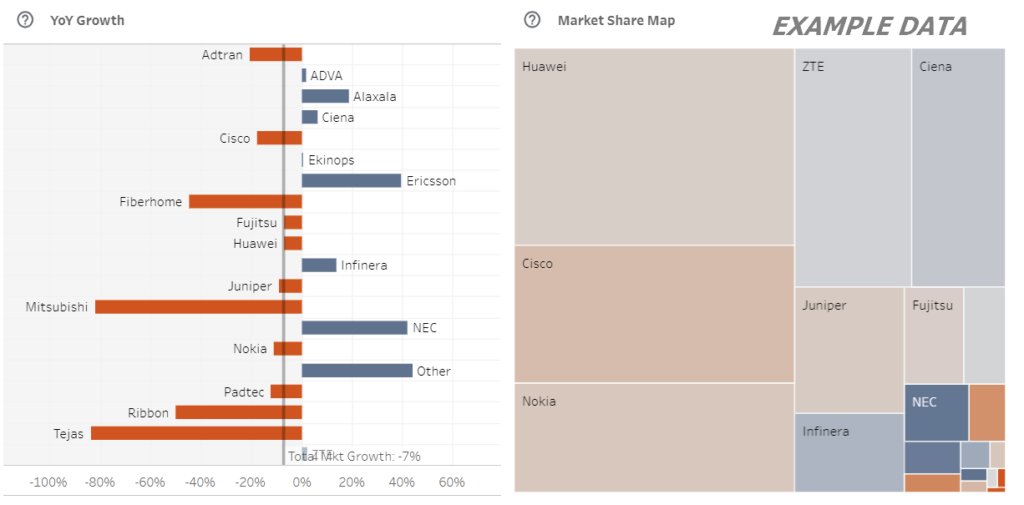

Cignal AI’s Transport Hardware Dashboard is available to clients of the Transport Hardware Report and provides up-to-date market data, including individual vendors’ results as they are released. Users can manipulate variables online and see information in a variety of useful ways, as well as download Excel files with up-to-date snapshots of market reporting.

About the Transport Hardware Report

The Cignal AI Transport Hardware Report is published quarterly and includes market share and forecasts for optical and packet transport hardware used in service provider networks worldwide. In addition to the interactive Superdashboard, analysis includes a detailed Excel database as well as PDF and PowerPoint summaries. Subscribers to the Transport Hardware Report also have access to Active Insight, Cignal AI’s real-time news service on current market events.

The report examines revenue for metro WDM, long-haul WDM and submarine (SLTE) optical equipment, and access, aggregation, edge, and core packet equipment in six global regions. Vendors in the report include Adtran, ADVA, Alaxala, Ciena, Cisco, Ekinops, Fiberhome, Fujitsu, Huawei, Infinera, Juniper, Mitsubishi Electric, NEC, Nokia, Padtec, Ribbon, Tejas, Xtera, and ZTE. A full report description, as well as articles and presentations, are available on the Cignal AI website.

About Cignal AI

Cignal AI provides active and insightful market research for the networking component and equipment market and the market’s end customers. Our work blends expertise from a variety of disciplines to create a uniquely informed perspective on the evolution of networking communications.

Contact Us/Purchase ReportSales: [email protected]

Web: Contact us