Trends in coherent technology generated enthusiasm among the participants at OFC 2018, and 400G ZR applications were of particular interest. Nokia and Infinera outlined next-generation coherent roadmaps, and Acacia and NTT Electronics showcased silicon fresh back from the fab. Many component companies announced smaller, lower cost devices to enable new WDM applications. In this report, Cignal AI examines OFC 2018’s coherent technology announcements and their implications.

Key Takeaways

- 400G ZR interest and investment is increasing as the addressable market for shorter reach coherent links grows. A year ago this technology was generally considered useful only for connecting large data centers. but now it is viewed relevant for links as short as 10km as a replacement for 400G LR4. Even lower cost and power 100G variants for Cable MSO fiber deep and 5G backhaul applications are feasible.

- Acacia, NTT Electronics, and Nokia all announced or demonstrated 600G DSPs. Acacia prototypes were fresh back from fab while NTT Electronics devices were already integrated and running in optical modules and equipment.

- Finisar, Oclaro, and Neophotonics announced highly integrated coherent optical assemblies for 600G, 400G ZR, and low-cost 200G DCO coherent modules.

- Several companies announced L-Band capable components and systems as operators struggle with diminishing gains in optical fiber capacity, even as speeds increase. Cloud and colo, as well as cable MSO operators, expressed the most interest.

Coherent in the Metro Edge

While the Lumentum/Oclaro news was the hot topic of the week, 400G ZR was the most discussed technology at OFC 2018. Even though there were no specific announcements regarding the ongoing development of the OIF 400ZR (120km) specification, multiple presentations illustrated broad anticipation of the benefits expected. 400G ZR is intended to address high volume optical metro-edge applications connecting data centers, 5G wireless, and cable MSO access nodes.

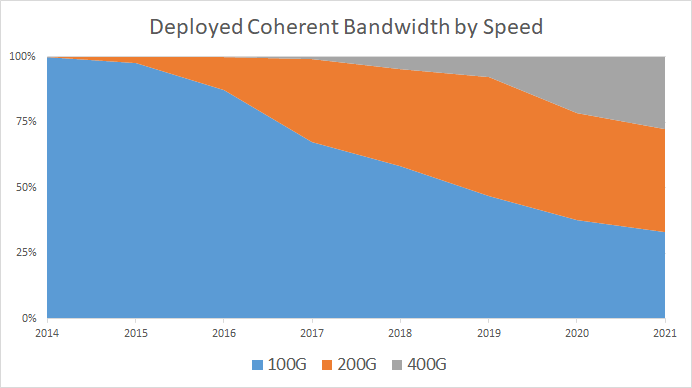

Coherent optical transmission is not the niche technology it was a decade ago. According to the operators and component makers presenting at OFC 2018, it will continue to spread into new optical networking applications as coherent speeds increase and price and power decrease.

Source: Cignal AI Optical Applications Report (1H17)

Recall that 400G ZR is designed to bring interoperability to coherent interfaces for reaches up to 120km and at speeds of 400G. The target module form factor is QSFP-DD or the OSFP, though every component maker we spoke with is working towards QSFP-DD (with the exception of Neophotonics).

Coherent 400G technology in the QSFP-DD format pushes the limits of space and DSP power consumption. Vendors are also hesitant about the high cost of developing the required 7nm DSP silicon – estimated by Arista to cost $10M to fab and $50M total to develop.

The addressable market for 400G ZR is growing, boosting the business case for this sizable investment. A year ago at OFC, 400G ZR was perceived as useful only for data center interconnect. This year illustrated a myriad of new applications and speeds that could extend volumes by an order of magnitude.

New Applications

120km was the original application 400G ZR was intended for. But discussions at OFC 2018 indicated that there are other applications both shorter and longer than this specification.

For example, Inphi now offers a 20km version of its 100G non-coherent ColorZ; a product based on interest from several large cloud customers. These customers appear to need only a fraction of the 120km capabilities of 400G ZR. Options like 400G versions of LR4 or ER4 don’t meet needs for WDM capabilities. Microsoft presented a histogram of fiber lengths in its metro networks, and almost all of its links were under 40km. Clearly, a dedicated shorter reach version of 400G ZR could have a significant market.

In the case of long reaches, Huawei made a Market Watch presentation outlining its research on 400G ZR capabilities and indicating that the low-power potential of the technology extended to reaches as far as 600km in form factors larger than QSFP28, such as 2x400G ZR in a CFP8.

Coherent Client Optics

Other vendors at OFC discussed modifying 400G ZR to provide an alternative to LR 10km optics. The current IEEE 400G LR8 specification is perceived as high cost and power, as it uses 8 separate wavelengths. The 100G Lambda MSA group proposed a more optimized 400G LR4 solution using 4 wavelengths.

A coherent implementation re-using the 400G ZR DSP and lower cost/power optics could be a competitive alternative to both of these solutions even at 10km distances, a strategy highlighted by Arista and Huawei. Acacia proposed that coherent technology coupled with silicon photonics might even be viable at 2km for 400G client operation. As one might expect, not everyone agreed. Fujitsu Optical Components felt a 400G LR4 module using 7nm PAM-4 silicon could be built both cheaper and lower power than a modified 400G ZR coherent solution.

Short reach coherent technology is still in its infancy but it is expected to encroach on 10km applications. Operators with a need to reach between 10km and 40km are almost certainly going to migrate to coherent 400G, and non-coherent solutions will not be competitive at distances greater than 10km.

Looking forward to 800G, there was a general consensus that coherent is the only solution for reaches beyond 2km. It’s just a matter of time until many shorter reach optics go coherent with the ZR based DSP as the enabling technology.

5G and Fiber Deep

Both cable MSOs and mobile operators will need more capacity than 10G optics can provide by 2020. 400G ZR is one possible solution, but in many cases, 400G provides more capacity than necessary. Such situations create an opportunity to repurpose the technology for 100G coherent operation.

Cignal AI estimates that 500,000 10G WDM pluggable modules are still sold each year, yet no viable technology exists today to migrate these 10G applications to 100G. Coherent optics have been too bulky, expensive, and powerful to replace the incredibly compact 10G tunable SFP+ solutions in use. A higher bandwidth solution will be needed soon.

Instead of upcoming 400G ZR solutions, alternatives using lower cost and power 100G coherent would provide an upgrade path for the 500k tunable 10G interfaces sold each year. Comcast detailed its shift to distributed access architectures (or ‘fiber deep’) in which high capacity digital optics are needed deeper in the network. Bottom line, 100G coherent optics could displace 10G at the right price and power.

Wireless network operators migrating to 5G need to deploy high bandwidth links to connect remote radios & antennas to centralized baseband units. Operators without plentiful fiber require cheap, low power, high capacity WDM solutions, as highlighted by China Mobile’s presentation. 100G coherent for wireless fronthaul/backhaul would be an ideal solution.

600G DSP Technology

Many component and equipment companies unveiled upgrades to coherent DSPs or updates to their technology roadmaps.

Acacia and NEL

Acacia and NTT Electronics (NEL) demoed new DSP technology in private. Both DSPs support 600G operation and are designed in 16nm silicon, but public details on performance and specifications are allusive. One equipment vendor had the new Acacia DSP in a private system demo. Most notable about this vendor is that it intends to pair the DSP with both silicon photonics and indium phosphide (InP) based solutions for the optics, and it does not see any major differences in performance between the two.

Acacia’s DSP is at the heart of several new compact modular systems as well as Acacia’s own AC1200 optical module. NEL has equipment and component partners who will bring systems as well as modules to market. Both companies demonstrated working silicon in partner and equipment customer booths and expect to have production silicon by the end of this year. Inphi also announced production availability of its 200G DSP.

Nokia

Nokia had a major announcement with the arrival of the PSE-3s, its new in-house DSP. Like the products of Acacia and NEL, it supports 600G operation. It differs, however, by incorporating a new technology – Probabilistic Constellation Shaping (PCS). Nokia states that PCS adds an additional optical dB of performance beyond the hybrid-modulation approaches used in the past.

It is notable that Nokia has chosen to continue designing its own DSPs rather than purchasing them from Acacia, Inphi, or NEL. Nokia feels doing so enables it to bring to market technology unique from that of other vendors sharing common hardware. This proved true with 200G coherent, as Ciena, Cisco, and Nokia designed their own DSPs and shipped most of the 200G hardware used outside of China during 2017. Each company states that vertical integration and control of the design cycle led to market success.

Those interested in more detail on this product can download a reprint of our report (.pdf).

Infinera

Infinera announced its fifth generation of coherent technology – the Infinite Capacity Engine or ICE5, also capable of 600G operation. Paired with the Infinera InP photonic integrated circuit (PIC), ICE5 supports 2.4 Terabits of capacity over 4 wavelengths.

Infinera was late in releasing the previous generation ICE4 product, which took longer than planned to bring to volume production. The ICE4 boosted speeds to 200G per wavelength and added much-needed flexibility to its tightly integrated multi-wavelength InP component, but the complexity was a development risk for Infinera.

The new ICE5 represents a more incremental R&D effort with minimal changes to existing InP components. The major difference is the electronics – a new outsourced DSP that supports higher baud rate operation and more complex modulations. The performance of the existing ICE4 PIC can support much higher baud rate operation and can be paired with the latest generation of DSPs to facilitate higher bandwidth. ICE5 based products will be announced later this year and are expected to reach production in 2019.

Infinera also foreshadowed the ICE6, which will make use of even higher baud rate operation which the company presented at ECOC 2017 (.pdf). While Infinera outsourced development of the DSP for this generation, speeds exceeding 100Gbaud will still require internal DSP development. The company anticipates a need for tighter integration of the photonics and electronics and expects that the ICE6 will require co-packaging of the DSP and InP based optics.

Additional Trends and News

Coherent components

Several companies announced new components designed to make coherent optics cheaper, smaller and faster. Each either announced or demonstrated monolithic InP devices that incorporate most or all of the optical components needed to build an optical sub-assembly (OSA). These devices are tested and calibrated in the factory, reducing the test and assembly complexity of equipment or module manufacturer customers. One point of annoyance is that none of the companies agree on what to call these devices, which are so similar.

Finisar announced its ITTRA (Integrated Tunable Transmitter and Receiver Assembly) which incorporates a tunable laser, optical amplifier, modulators, coherent mixers and driver electronics. It can support up to 200G 16-QAM operation and is clearly a solution for Huawei’s effort to build in-house 200G CFP-DCOs. The device will sample in 2Q18.

Neophotonics claims to be the only company currently shipping 400G discrete coherent optical components in production. It also announced a COSA (coherent optical sub-assembly) that integrates all of the needed coherent components (except the laser). The Neophotonics COSA is capable of 64Gbaud operation and is designed to pair with 400G ZR DSPs that will prototype late this year.

Oclaro’s demonstrated 400G and 600G components including a TROSA (transmit and receive optical sub-assembly) similar to the Neophotonics part, except it includes the narrow linewidth laser. These are follow-on components to its tremendously successful CFP2-ACO designs.

Silicon photonics continues to incite sharp opinions among the component crowd, with every company firmly believing either InP or Silicon will be the medium of choice for upcoming 400G ZR solutions.

L-Band Amplification

Once an esoteric technology, L-Band amplification is now moving into the mainstream. Coherent speeds are increasing but at the expense of using more and more optical spectrum. The amount of capacity supported by the C-band is topping out, and fiber-constrained network operators view L-Band as an additional optical spectrum that can delay purchasing or trenching new fiber. Cloud and colo networks are the first targets for L-Band amplification, but companies are seeing strong interest from Cable MSOs as well.

Infinera, Cisco, Ciena, and others are on board, and they used OFC to announce equipment supporting this additional optical spectrum. Specific features mentioned will minimize the additional hardware and complexity needed to work with L-Band. The result should be new amplifiers, WSS modules, and transponders that can work across the spectrum.