After much of the world already transitioned to all-optically switched ROADM networks, Chinese network operators are preparing to follow suit. Most networks outside of China used optical switching as early as a decade ago, yet China chose to deploy massive electrical OTN switches instead, powered by technology from Huawei and ZTE. But now the writing’s on the wall; electrical switching can no longer scale to the sizes needed by China Mobile and China Telecom, and these operators are now moving forward with ROADM optical switching.

This transition will unfold with a different timeline than Cignal AI initially anticipated and we have updated our position on China’s 2017 ROADM deployment. Instead of pursing rapid deployment, Chinese operators will take a more conservative stand by minimizing the deployment of conventional ROADM architectures during 2017 and 2018.

In this report, Cignal AI examines what technology China has deployed to date, outlines changes in ROADM architectures, and explores the ripple impact on the optical component and semiconductor supply chain.

Summary

- In the past, China chose not to deploy ROADMs for many valid reasons, but it cannot escape the reality that its electrical switching solutions can no longer scale to required densities. A transition to ROADMs is necessary.

- So far, there have been only limited deployments of both CD (colorless + directionless) and CDC (+ contentionless) ROADMs in China. During 2017/2018, Cignal AI expects slower deployment of mostly CD ROADMs in the region. The transition will unfold conservatively as operators delay CDC deployments until equipment vendors develop improved hardware architectures.

- The new, improved CDC ROADM architectures will eliminate the optical multicast switch (MCS) and amplifier arrays with a new wavelength selective switch (WSS) that has multiple input and outputs – an MxN WSS.

- Demand for WSS reflects a slower than expected ramp in China. Longer term, China ROADM consumption represents an additional 20% to 30% revenue opportunity for ROADM equipment and components from existing levels.

- Demand for MCS components will diminish in China over the next 1-2 years due to a preference for CD architectures. In the longer term, MCS components will not be required for CDC ROADM deployments worldwide if the MxN WSS meets technical and cost expectations.

Why No ROADMs in China?

This is a question we’ve wrestled with for the past decade. Why would multiple operators in the same country avoid using a technology that offers a clear reduction in cost? As early as 2010, we met with China Mobile and China Telecom to gauge when ROADM technology would be introduced in the country. The answer to our question was consistent; “ROADMs are not for us.” The underlying reasons why this was so were varied. Our conversations over the last five years gave us several explanations:

- The technology was difficult to deploy, and there was concern that regional operators in China could master the link engineering to get it to work reliably.

- Chinese networks were rarely reconfigured, so the use of fixed optical add/drop modules was sufficient.

- The core networks had spans that were too long to use more than one or two ROADMs.

- OTN-based electrical switches provided deterministic and predictable performance, particularly for failure restoration. The optical engineering required with ROADMs could not.

All the reasons above, and particularly the last, compelled Chinese carriers to use OTN-based electrical cross connects rather than pursue ROADMs. Huawei benefitted from this situation and became a technical leader in OTN switching as well as the world’s largest supplier. Huawei, followed by ZTE, built larger and larger cross-connects, but eventually it could not keep pace with the burgeoning demands of major Chinese cities. Operators deployed OTN switches in blocking architectures to compensate, but it was at this point that they realized they had pushed electrical OTN switching technology too far.

When Chinese network switching requirements exceeded electrical OTN switches capabilities, adopting ROADMs became the only sensible option. As a result,, Chinese operators are finally embracing ROADMs and pairing them with existing OTN switching to minimize the required size of the electrical switching fabrics.

China ROADM Deployment

That said, the ROADM usage in China to date is minimal. China Mobile and China Telecom have only executed token deployments which followed a period of trials of both CD and CDC ROADM node architectures undertaken by the two companies.

China Telecom

Shanghai Telecom (a regional China Telecom network) installed a 16-node Metro WDM ROADM network spanning the geographically compact province using a mix of CD and CDC nodes, including some nodes with support for as many 20 degrees.

China Telecom deployed 19-nodes in its national network, spanning six provinces along the Yangtze river. This installation utilized Huawei equipment and initially used a mix of both CD and CDC nodes. A recent Huawei press release stated that this network ultimately became a 21-site installation, and exclusively CD. This backing away from CDC to CD architecture is an example of a larger trend we will explore later in the article.

China Mobile

A representative from China Mobile reported the company had about 300 active ROADM nodes, though it isn’t clear as to what percentage of these are in lab trials vs. already deployed in the network. The deployed ROADM nodes are in the Pearl River area (Guangdong Province) as well as the Zhejiang and Jiangsu provinces. The operator is moving forward with installations in both the national and regional networks.

The company is doing testing with CDC ROADMs, but according to the contact we spoke with they consider the solution too complex, and are waiting for the new architecture.

Outlook

How big is the Chinese ROADM opportunity? Consider that total optical hardware spending in China in 2017 is roughly the same as total spending in North America. The difference is that there is virtually no spending on ROADMs in China yet. If Chinese regional operators were to deploy ROADMs on the same scale as Verizon and other North American operators, the opportunity within China would be roughly the same as is represented by current spending in North America. Under this scenario, China would be expected to add at least 20-30% to worldwide WSS component and ROADM equipment demand.

Chinese operators are making ROADM deployment at the interface between the national network and the regional province networks a priority. This was the focus of China Telecom’s six province installation in the Yangtze region. Once China Telecom has evaluated the results, it may replicate this approach in 5 other natural province groupings throughout the country.

China Telecom Province Map (ROADM)

The national network ROADM installations are significant in volume, but they are only the first step. The true volume opportunity for ROADMs in China exists within the provinces themselves, such as the initial 16 node installation by Shanghai Telecom. Note that this was a relatively small deployment; in comparison, Verizon’s metro ROADM network has as many as 200 nodes in a large city.

In summary, after evaluating both CD and CDC ROADM architectures, China Telecom and Mobile have decided to deploy CD primarily, and eschew CDC. It also appears Chinese operators will deploy ROADMs more conservatively during 2017 than we expected at the beginning of this year. Both outcomes are a result of operators, led by Huawei, adopting a slower approach while equipment vendors bring next generation CDC ROADM technology to market.

Evolution of CDC Hardware

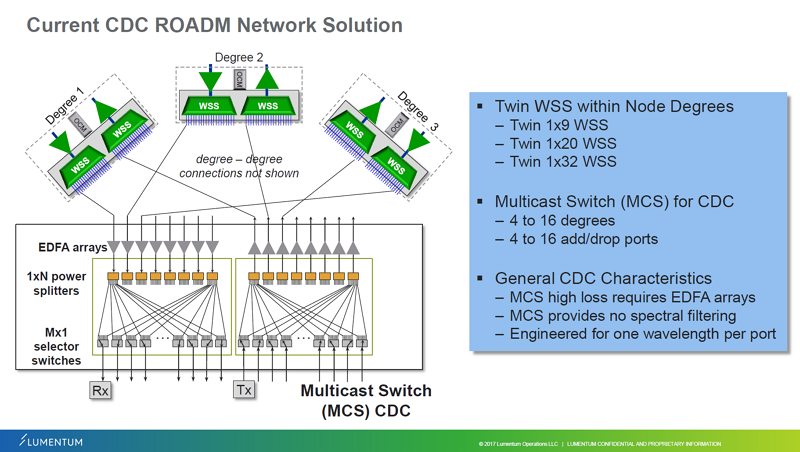

MCS-based add/drop modules for CDC ROADMs introduce performance penalties when compared to straightforward CD ROADMs, while also adding cost. The MCS is only a space switch – it has no wavelength level switching – and some system-level issues are a result.

- Existing MCS components have high optical loss incurred through the splitting of the input power across many possible outputs. This loss necessitates the addition of an EDFA array for ROADM nodes that are more than a few degrees.

- The power of the EDFA array is limited. As MCS output ports increase, the EDFA power is split proportionally. It is not possible to amplify more than a few wavelengths per output port in high port count configurations, prohibiting the use of multi-wavelength super-channels.

- MCS’s cannot provide spectral shaping or blocking, which burdens optical receivers of dropped wavelengths with additional noise. This characteristic also makes CDC ROADMs impractical for non-coherent traffic.

- The lack of spectral blocking also allows wideband noise from multiple wavelengths added at the node to accumulate, reducing OSNR.

Conventional CDC Hardware Architecture – used with permission from Lumentum, presented NGON 2017 Nice, France

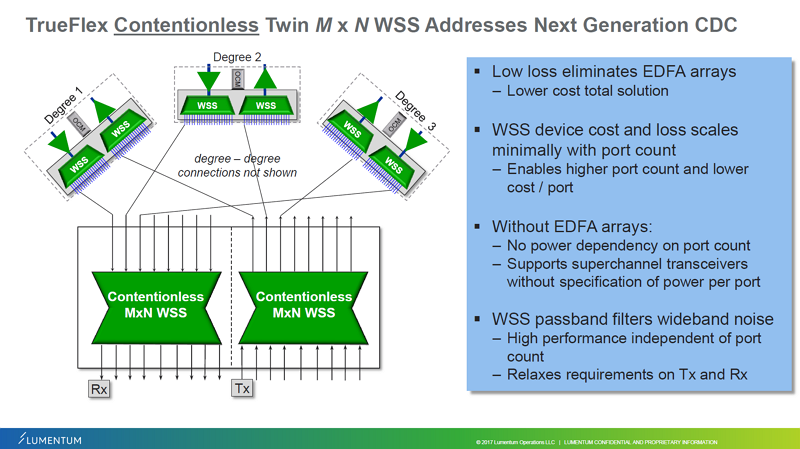

An architecture has been proposed by Lumentum and advocated by Huawei (and has the interest of Chinese operators), which addresses these drawbacks. It replaces the entire EDFA/MCS sub-assembly with a MxN WSS that has operating characteristics like a traditional WSS and the high port count of an MCS.

Unlike a conventional WSS that is 1×4, or as large as 1×20, the MxN has multiple ports on both sides. Configurations such as 8×16 or eventually 32×16 are possible, allowing the MxN to replace the existing MCS/EDFA array based module.

Add/Drop WSS CDC Hardware Architecture – used with permission from Lumentum, presented NGON 2017 Nice, France

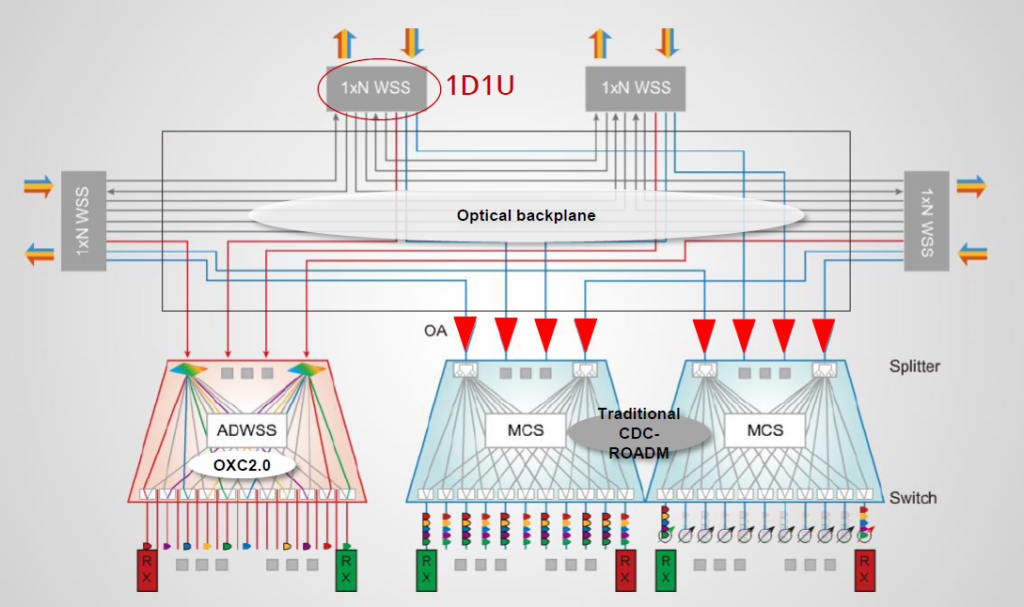

Huawei has pre-announced equipment based on this technology. It incorporates some additional innovations beyond the MxN WSS such as an optical backplane, but it is the first announced product to implement this improved CDC ROADM architecture. It is scheduled to ship next year. We expect that other western equipment manufacturers are pursuing CDC ROADMs with MxN switches, but have not made these developments public.

Huawei OXC 2.0 ROADM Architecture

Impact on Market

Our conclusion is that the deployment of ROADMs in China will progress, but at a slower pace than we first anticipated at the beginning of this year. At the operator level, the urgency to put ROADMs in the network is less than what was expected 6-9 months ago. Huawei appears to be encouraging and influencing operators to practice some patience and wait for the latest ROADM architectures which are expected in 2018.

WSS Component Vendors

This conservative approach in China’s CD ROADM deployment will result in lower Chinese consumption of WSS modules than our previous estimates. It is important to note that Huawei and ZTE also purchase WSS components for use in equipment exported outside of China, and this demand is not impacted by the slow pace

Operators in the west are also interested in the new MxN based CDC architecture, but we have not confirmed that anyone outside of China is adjusting deployment to wait for the new technology. For example, Verizon is fully aware of the situation, but it is still moving forward with its existing ROADM architectures, and is very satisfied with the current technology. The overall impact on worldwide WSS demand is minor, with only a slower than anticipated ramp in China as those operators move more slowly.

Lumentum is considered a likely supplier of the new MxN WSS, and the company is currently sharing and presenting this architecture at technical conferences. We expect that Huawei will bring its new ROADM to market in 2Q18, and given the required 6,000 hour testing for components (250 days), this would require that the Lumentum device is nearing production form.

MCS Component Vendors

The MCS is a central component of existing CDC architectures. The short-term impact on MCS demand is like that of the WSS, with no changes expected from existing sources of demand. However, the bias towards CD architectures in China removes this region as a source of potential market expansion.

If things unfold as we expect, MCS demand within China will be minimal. CD ROADM architectures (no MCS needed) will be primarily used in China for the next 1-2 years. Long term, CDC architectures using a combination of standard WSS and MxN WSS will eliminate the need for an MCS altogether. Should this be the case, the market for MCS components is nearing its peak over the next year, before the introduction of the MxN based approach.

All of these conclusions, are contingent on Lumentum’s successful execution of its challenging R&D program. In addition, another source of MxN WSS supply will be required before equipment vendors will fully commit to this approach.

OTN Semiconductors

Because of its widespread OTN switch deployment China is a voracious consumer of OTN silicon. Microsemi and MACOM are the largest suppliers of commercial OTN silicon, though some FPGAs are used in certain applications and vendors.

We have concluded that while ROADM deployment in China will supplant a portion of the growth in OTN switching equipment, the use of OTN and the semiconductors needed for this equipment to will not substantially decline.