Ciena and Nokia Lead in Cloud and Colo Market Share

BOSTON (June 13, 2017) – Growth in the optical market is being fueled by strong demand from cloud and colocation providers as well as incumbent telcos in China, according to the recent Optical Customer Markets Report from Cignal AI, a networking component and equipment market research firm. The report thoroughly quantifies the buyers of optical equipment and forecasts demand in multiple end markets.

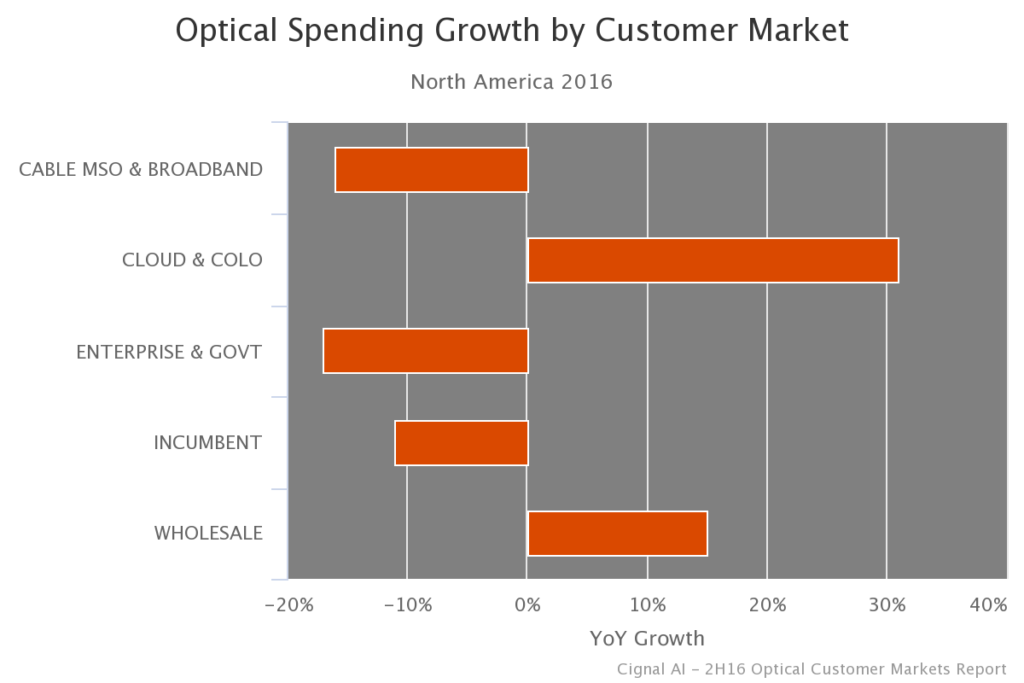

“The composition of optical equipment demand has changed dramatically over the past five years, as cloud companies such as Amazon, Google and Microsoft have become the predominant source of growth in optical transport equipment purchasing,” said Andrew Schmitt, lead analyst for Cignal AI. “In 2017, we expect cloud and colo customer demand in North America to exceed that spent by all the cable MSOs.” The report further described that ADVA Optical Networking, Ciena, Infinera, and Nokia are the key beneficiaries of this demand from cloud and colo providers.

Produced twice a year, the Optical Customer Markets Report examines the market share of optical equipment spending by five key customer markets –incumbent, wholesale, cable MSO and broadband, cloud and colo (ICP), and enterprise and government. The report also includes forecasts based on expected spending by customer markets on a regional basis, and equipment vendor market share for sales to the cloud and colo market.

Key findings in the report include:

- Even though incumbent expenditures remain the largest portion of the market, cloud and colo providers and Chinese incumbents are responsible for almost all spending growth.

- Incumbent spending in North America, which was half of all spending in 2014, will drop considerably by 2021.

- Cloud and colo growth is centered in North America, but will extend into EMEA and APAC in 2017 and beyond.

- Ciena and Nokia were leaders in sales to the cloud and colo market.

- ADVA cloud and colo revenues grew over 40 percent in 2016, faster than any other vendor.

- APAC cloud and colo demand remains small, but will see some growth as Baidu, Alibaba and Tencent begin more limited network builds.

- In China, the incumbent operators remain massive purchasers, however their overall spending will decrease as a share of the total APAC market.

- Outside of Asia, declines in purchases by incumbents is expected as well. But that drop will be offset by cloud/colo and wholesale vendor spending. This trend is a result of more traffic and content being routed around incumbent networks, being carried instead by cloud and wholesale companies.

About the Optical Customer Markets Report

The Cignal AI Optical Customer Markets Report tracks optical equipment spending by end customer market type and provides forecasts based on expected spending trends by customer market on a regional basis. Deliverables include an Excel file with complete data set, PowerPoint summary and Optical Equipment Active Insight.

The report includes revenue-based market size for all end customer markets across all regions, with vendor market share for the cloud and colo segment broken out on a worldwide basis. Vendors examined include Adtran, ADVA Optical Networking, Ciena, Cisco, Coriant, ECI Telecom, Ekinops, Fiberhome, Fujitsu, Huawei, Infinera, Juniper, NEC, Nokia, Padtec, TE Connectivity and ZTE.

Full report details, as well as articles and presentations, are available to users who register for a free account on the Cignal AI website.

About Cignal AI

Cignal AI provides active and insightful market research for the networking component and equipment market and the market’s end customers. Our work blends expertise from a variety of disciplines to create a uniquely informed perspective on the evolution of networking communications.

Contact Us/Purchase Report

Sales: [email protected]

Web: Contact us