The optical networking world finally gets a close up view of Acacia’s performance as the company is filing for an IPO. The most recent S-1/A filing by Acacia includes 2015 financial details, which we review through the lenses of Cignal AI’s customer and market knowledge in order to create a fine-grained view of the company’s performance and qualitative outlook. This analysis includes a detailed projection of customer composition for 90%+ of revenue, market share within entire 100G market, and estimates of ASPs beyond what is included in public documents.

OVERVIEW

Founded in 2009, Acacia has achieved notable financial performance riding the 100G technology wave even though it addresses only a portion of the 100G market. Acacia benefitted from vertical integration by large network equipment manufacturers designing their own 100G coherent modules (such as Ciena, Cisco, and Alcatel-Lucent), which closed off a significant portion of the market. But recently Acacia appears to have finally succeeded with key accounts like Cisco.

Acacia is highly regarded by our contacts as a company possessing exceptional technical leadership and execution. It is considered one of the best sources of coherent technology and provides its products to many smaller, non-vertically integrated manufacturers, enabling them to be competitive with larger firms.

Acacia’s IPO is important for all private optical startups and serves as the ultimate mark-to-market for investors. Two separate sources at OFC were convinced that private valuations of companies such as Kaiam and Luxtera are unreasonably high. As a result, the industry remains in hold mode as it waits to see what multiple is to be given to rapidly growing revenue streams in this sector.

According to several sources, Acacia was scheduled to go public the week of March 7th, but the offering was withdrawn with the news that shipments to ZTE have been banned. We have no word on when the company will go public now, and expect to see an amended S-1 from the company citing this risk before the offering transpires.

According to the S-1/A, the Acacia IPO proceeds are newly issued shares intended to support further investments by the company; insiders will be selling few shares as part of the initial offering. The IPO is not a means for insiders and investors to obtain immediate liquidity – the IPO is meant to raise additional capital for the company.

REVENUE

The company posted the following revenue by region:

| Figures in $MM | 2013 | 2014 | 2015 |

|---|---|---|---|

| Americas | $13.9 | $32.1 | $46.6 |

| EMEA | $37.9 | $60.1 | $103.2 |

| APAC | $25.8 | $54.0 | $89.3 |

| Total | $77.7 | $146.2 | $239.1 |

| Gross Margins | 38% | 36% | 39% |

Clearly, Acacia has had some spectacular growth, especially given that the company has captured only a small fraction of the 100G coherent market to date. Its gross margins are more in-line with those of equipment makers (40%) instead of component manufacturers (30%), which is a reflection of the value of the company’s optical subsystems.

The comments in the S-1/A IPO document also shows that Acacia shipped a total of $11M in 400G (2x200G) product in 2015; 2/3rds of which went to China. Acacia’s 400G product should see an exceptional jump in 2016 as ADVA rolls out its data center product using the module, and other customers like Coriant that only use the DSP grow as well.

MARKET SHARE

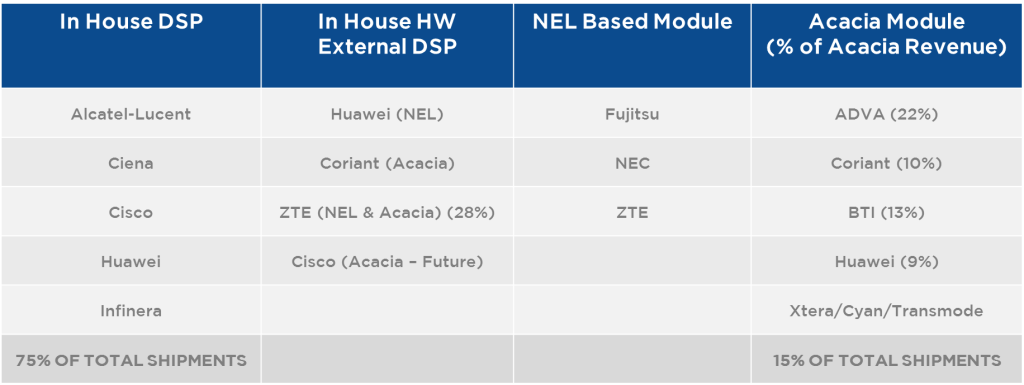

In order to understand Acacia’s market position, one must look closely at the small portion of the market it currently addresses and the consequent opportunity the company has to substantially increase its number of customers. We estimate that Acacia supplied either module or DSP technology to about 15% of the market during 2015.

Two companies in particular provided Acacia with the majority of its early revenue growth – ZTE and ADVA- the early partnerships with both are disclosed in the S-1 (See Adva). While ZTE has more recently eased off as a growth engine, Acacia will leverage the new 400G module and DSP for continued growth in 2016. Revenue from this product will be centered at Chinese customers, Coriant, ADVA, and eventually others.

In 2015, we sold our optical interconnect products to more than 25 customers. Historically, our sales have been primarily to network equipment manufacturers that do not have internally developed coherent DSP ASICs. More recently, we have had success in marketing and selling our products to network equipment manufacturers that have internally developed their own coherent DSP ASICs.

We’ve learned that one of the previously vertically integrated WDM providers designed an Acacia DSP in some products, something hinted at in the Acacia S-1. We have a high degree of confidence that this company is Cisco; Cisco has made a decision to outsource DSP development for some of its products. Cisco ships the lowest amount of coherent 100G ports of all the vertically integrated suppliers; this could be the beginning of a pragmatic outsourcing decision. In the meantime it appears they are continuing to use in-house silicon for applications where they feel they have a competitive advantage (250G per lambda).

We also expect Nokia to make a similar decision to exit DSP development though we don’t which DSP vendor they will choose. It is with noting that the above language in the S-1 is plural, implying that there is another company involved besides (presumably) Cisco.

Ciena and Infinera both remain holdouts as they are the acknowledged heavyweights of the vertical integration market (particularly Infinera) and have successfully exploited their technical advantages in the market.

REVENUE BY CUSTOMER

The S-1 also provides detail on Acacia’s revenue by sub-region as well as on unnamed customers beyond ZTE and ADVA. There is also detail on the revenue of the company’s five largest customers by year. Infusing this data with our knowledge of customer shipments and design wins along with educated estimates creates a picture of the company’s revenue sources. Some of the data below is estimated (E).

| Figures in $MM | 2013 | 2014 | 2015 | Share (2015) |

|---|---|---|---|---|

| ZTE | 24.9 | 51.8 | 66.0 | 28% |

| ADVA | 10.6 | 34.2 | 53.1 | 22% |

| Coriant (E) | 0.0 | 3.9 | 24.8 | 10% |

| BTI Systems (E) | 5.0E | 12.0E | 31.1 | 13% |

| Huawei (E) | 0.0 | 1.6 | 20.1 | 8% |

| ALU | 14.9 | 7.0E | 2.9E | 1% |

| EMEA | 11.6 | 14.0 | 21.4 | 9% |

| USA | 6.6E | 18.4E | 11.2 | 5% |

| APAC | 0.9 | 0.7 | 3.2 | 1% |

| Americas | 2.4 | 1.7 | 4.4 | 2% |

| France | 1.2 | 1.0E | 1.0E | 0% |

CUSTOMER DETAILS

ZTE

This is Acacia’s largest customer. Revenue to ZTE represents a combination of both AC-100 MSA module revenue as well as DSP-only revenue in later years. The pricing for a module is much higher than the pricing for a DSP chip. We do not know the mix of module shipments vs. DSP consumption at ZTE, and therefore it is difficult to deconstruct this number any further.

ZTE also uses NTT Electronics as another source, further complicating the calculation of Acacia’s share at this customer. The shift by ZTE from using higher revenue modules to lower revenue DSPs is the likely reason that revenue growth with this customer slowed down in 2015.

ADVA

ADVA was largest source of revenue growth in 2015 and a remains a key technical partner for Acacia. The new datacenter-focused chassis from ADVA is built around the new Acacia 2x200G module and represents a bet by ADVA that Acacia can provide competitive alternatives to the solutions produced by Ciena, Cisco and Infinera.

Juniper/BTI

Juniper acquired the assets of BTI Systems after making a substantial earlier investment in the company. We estimate that BTI was Acacia’s 3rd largest customer in 2015. BTI has excellent optical engineering skills and is likely to form the nucleus of Juniper’s efforts in the optical layer realm. Forced to guess, we would expect to see Acacia secure future business with Juniper as part of the transition.

Coriant

We assume that the majority if not all of other revenue associated with Germany (besides ADVA) belongs to Coriant, the assets previously known as Nokia Siemens Networks and Tellabs. It is unclear if shipments to Tellabs legacy systems are counted as American or German revenue, if the former, Coriant revenue could be even higher.

Coriant originally used the NTT Electronics DSP but later moved to Acacia’s technology and now uses the company’s 2x200G DSP as the central technology for its DCI-focused Groove platform and its 7300 transport system. Coriant differs from ADVA in that it uses only the DSP, not the module, as it chooses instead to add value through its in-house designed optics. Coriant indicated that it plans to use silicon photonics based CFP2-ACO in the Groove, a product recently announced by Acacia and the likely vendor.

Huawei

Huawei purchases the Acacia CFP module for pluggable applications. For the majority of its coherent shipments, the company uses a mix of a Clariphy-based ASIC and NEL DSP silicon in non-pluggable solutions. Huawei is in the process of converting to an internally designed coherent CFP using HiSilicon technology for 2016; it is unclear what share Acacia or NEL will have in this space going forward, though executives at Huawei indicate they are still in active discussions with the company.

EMEA (Ericsson, ECI)

Most of this extra EMEA revenue originates from Ericsson’s use of Acacia in legacy Marconi assets as well as deployments in ECI equipment.

USA (Tellabs, Xtera, Cyan)

There are several potential customers in the US market. Tellabs was likely a source of revenue in 2013, though it is unclear how revenue recognition was handled after the Coriant acquisition (USA vs. Germany). Cyan shipped a material amount of 100G, particularly in 2014, to Windstream. Juniper has worked with virtually every 100G vendor and according to appendix filings in the S-1 document was designated as an Acacia partner in 2011. The revenue per customer picture for 2015 is a bit muddled and difficult to deconstruct, as Acacia has succeeded with a number of equipment vendors, including IPoDWDM applications at router/switch vendors.

COMPONENT PRICING

We cannot accurately pinpoint DSP prices at ZTE or Coriant, but based on revenue to several equipment suppliers and knowledge of quantities those companies shipped, we can deduce a reasonable approximation of average pricing.

Average module pricing for Acacia in 2014 was $23,000 per unit and $17,500 in 2015. Note: this is a blended number of both pluggable CFP and MSA, but is still an interesting benchmark – particularly in consideration of the 24% YoY reduction in price.

NOTEWORTHY

- VCs and employees are not planning to sell any material amount of shares in the IPO. The founders indicate they will sell about 10% of holdings, provided the offering is oversubscribed. This is a capital raising event for Acacia, not an immediate liquidity event, though the VC will then be able to distribute share to limited partners.

- With the majority of its revenue generated overseas, Acacia is in the process of restructuring its international operations with subsidiaries in Bermuda and Ireland in order to minimize US corporate taxation.

- “We are also developing optical interconnect modules that will enable transmission speeds of one terabit (1,000 gigabits) per second and more.”

- Viasat filed suit against Acacia in January of 2016 “alleging, among other things, breach of contract, breach of the implied covenant of good faith and fair dealing and misappropriation of trade secrets.” Viasat was a source of forward error correction intellectual property for other chip developers and probably was a source for Acacia as well. Acacia currently pays royalty expenses of $15/$17/unit to someone.

- 180 day lockup on all insider shares not sold at the offering.

Full IPO filing and S-1A document here