1Q25 Optical Component Report

Datacom revenues and shipments slowed, 400ZRx shipments kept Telecom revenue growing for a fourth consecutive quarter.

1Q25 Transport Hardware & Markets Report

The Optical and Routing markets show signs of recovery, and tariffs aren’t yet affecting business.

1Q25 Preliminary Transport Hardware & Markets Report

The Optical and Routing markets show signs of recovery, and tariffs aren’t yet affecting business.

Nokia 1Q25 Vendor Summary Report

Nokia closes the Infinera acquisition and sees significant YoY growth in both IP and Optical.

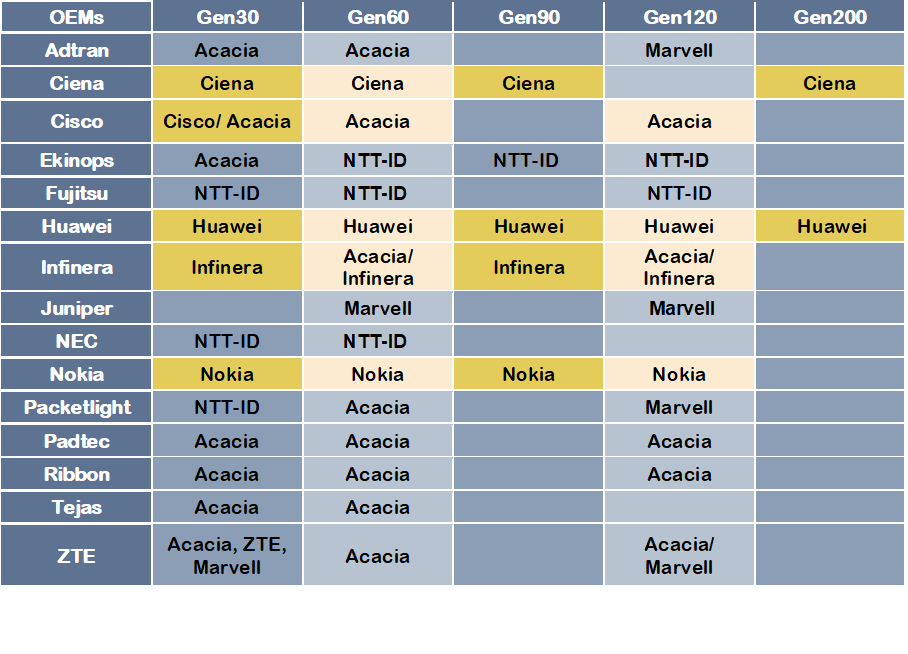

Tracking the Coherent DSP Supply Chain – 2025

Uncovering who uses which DSP, and which DSP vendors ship the most volume.

4Q24 Optical Component Report

Datacom revenue and port shipments stalled this quarter. Telecom revenue recovered from the doldrums based on 400G pluggables.

Updated: Nokia Acquires Infinera

Two Markets, Two Product Lines

4Q24 Interim Optical Component Report

Final report will be issued once all Chinese companies complete 4Q24 reporting.

4Q24 Transport Hardware & Markets Report

Carrier caution has resulted in underinvestment, and networks are now running “hot” enough to require upgrades and expansion.

Nokia 4Q24 Vendor Summary Report

Nokia sees light at the end of the spending downturn tunnel, but Optical and Routing revenue remain at historically low levels.

4Q24 Preliminary Transport Hardware & Markets Report

Carrier caution has resulted in underinvestment, and networks are now running “hot” enough to require upgrades and expansion.

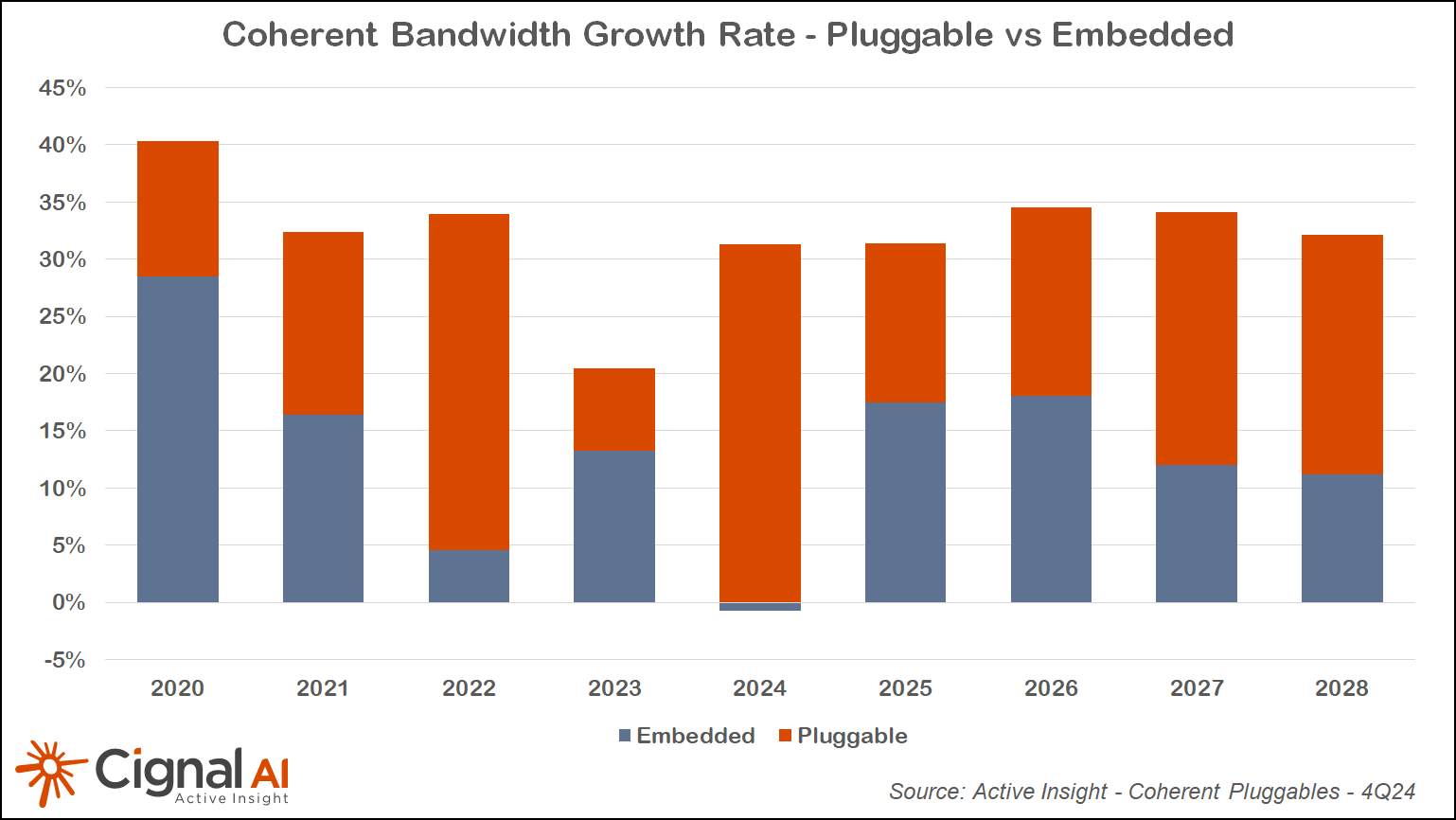

Coherent Optics: It’s a Pluggable World

Coherent pluggable optics were responsible for all the telecom bandwidth growth in 2024, and will account for most of the future growth.

3Q24 Optical Component Report

Datacom revenue more than doubled for the second quarter in a row as AI demand for 400GbE and 800GbE modules continued unabated. Telecom revenue has emerged from the depths of its recent decline.

3Q24 Transport Hardware & Markets Report

Optical spending by Cloud & Colo operators grew 7% worldwide, while spending by Service Providers declined -17%.

3Q24 Preliminary Transport Hardware & Markets Report

Optical sales fall -14%, but are buffered by strong sales to Cloud and Colo operators.

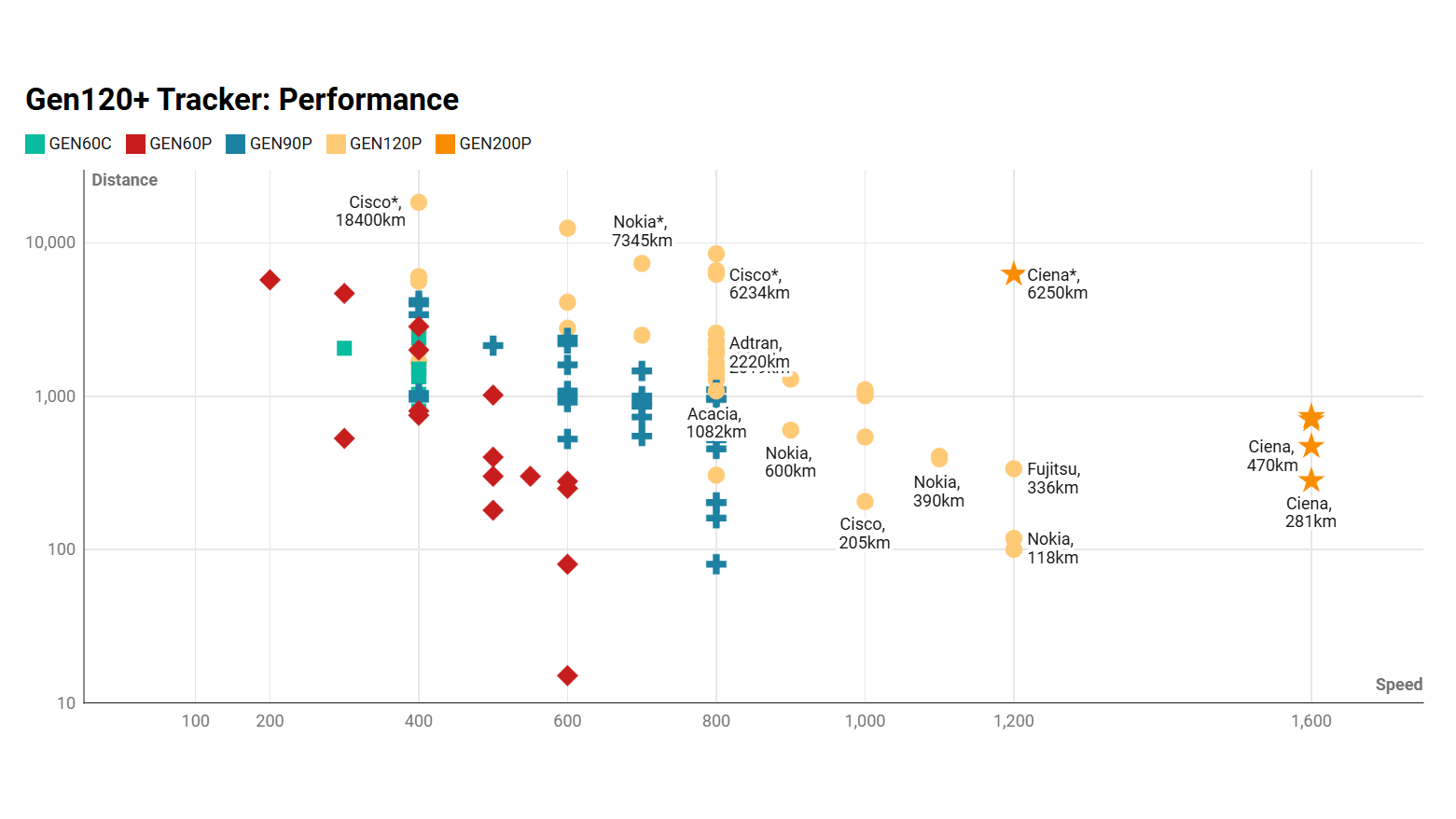

GEN120+ Coherent Trials and Deployments

Cignal AI is tracking announcements of Gen120 (120+ GBaud, 1+Tbps) optical trials and deployments.

ECOC 2024 Show Report

Nvidia PAM-4 DSP, Ciena 2x 800G-LR, LPO Lives, 1600ZR slipping, L-Band ramping.

2Q24 Optical Component Report

Datacom revenue hit new records with a surge in 400GbE shipments and continued growth in 800GbE. Telecom’s only growth area is 400G coherent pluggables.

2Q24 Transport Hardware & Markets Report

Optical sales fall -18% as carrier inventories take longer to deplete than anticipated.

2Q24 Preliminary Transport Hardware & Markets Report

Optical sales fall -18% as carrier inventories take longer to deplete than anticipated.