4Q18 Optical Applications Report

Cignal AI’s 4Q18 Optical Hardware Applications Report has been issued.

4Q18 Optical Hardware Webinar

Cignal AI presents the results from the 4Q18 Optical Hardware Report.

OFC2019 – 5G and MSO Access

5G mobile technology and the cable/MSO initiative Fiber Deep are generating interest in new and unique optical networking solutions

OFC2019 – Open and Disaggregated Networks

Open and disaggregated network equipment, software, and standards were a common theme on the floor and in presentations at OFC this year.

OFC2019 – Compact Modular

The compact modular format continues to be the fastest growing segment of the optical hardware market. In this section, the announcements and demonstrations at OFC are detailed.

OFC2019 – Coherent Technology

Coherent announcements and roadmaps at the show focused on two themes: lowering the power of coherent technology for use in pluggable applications and increasing baud rates to raise the maximum capacity of a single wavelength beyond 600Gbps. And despite few new ROADM announcements, there was a spirited debate about future ROADM architectures.

4Q18 Optical Hardware Report

This report finalizes our full optical equipment market share analysis and includes updated forecasts for the industry through 2023.

Infinera 4Q18 Vendor Summary Report

Vendor summary reports focus on the most recent quarterly financial results and items of interest for select vendors. This report covers Infinera’s 4Q18 results.

Infinera Announces ICE6

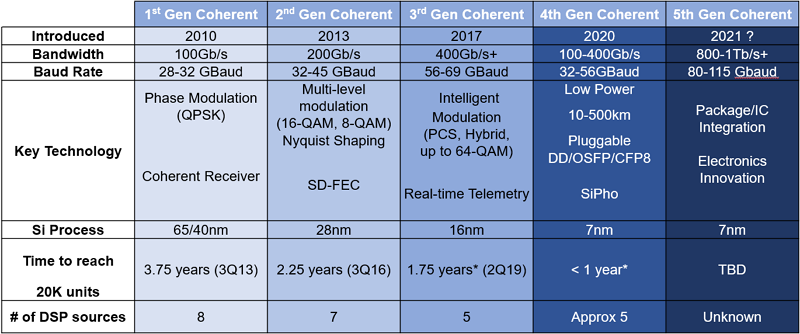

Infinera announced the details and schedule for ICE6, its next-generation coherent engine featuring 800G operation. It is a 1.6T monolithic PIC co-packaged with a new internally developed 7nm DSP.

4Q18 Optical Hardware Tracker

The Cignal AI 4th quarter 2018 (4Q18) Optical Hardware market share tracker is now active. This interactive page tracks hardware sales as results are reported for the quarter.

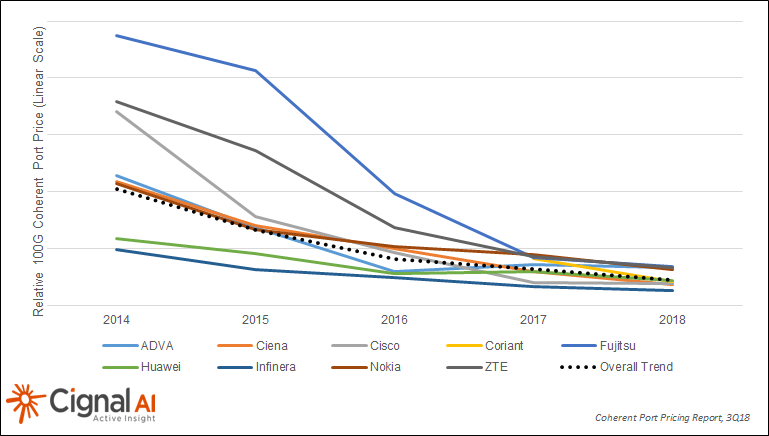

3Q18 Coherent Port Pricing Trends

This report examines trends in coherent port pricing from multiple vendors and for the industry overall.

3Q18 Optical Hardware Webinar

On December 13, 2018, Cignal AI presented their results from the 3Q 2018 Optical Hardware Report.

3Q18 Optical Customer Markets Report

Cignal AI has issued the 3Q18 Optical Customer Markets Report.

3Q18 Optical Applications Report

Cignal AI’s 3Q18 Optical Hardware Applications Report has been issued.

400ZR – The 4th Generation Coherent Opportunity

The arrival of standardized, pluggable 400ZR and derivative technologies – fourth generation coherent – is poised to be the most disruptive event in optical hardware since the advent of coherent 100G in 2010.

3Q18 Optical Hardware Report

This report finalizes our full optical equipment market share analysis and includes updated forecasts for the industry through 2022. It is released once results for the current quarter (3Q18) are complete. Clients have been able to see company results as they were released during the quarter via the Optical Hardware Tracker, a service unique to Cignal AI.

3Q18 Optical Hardware Tracker

The Cignal AI 3rd quarter 2018 (3Q18) Optical Hardware market share tracker is now active. This tracker allows clients to download a real-time view of industry results as companies report. Updates are made continuously and are reflected in the tracking table below.

New York Investor Visits – Raymond James

On November 5th, Andrew Schmitt and Scott Wilkinson traveled to New York for a day of 1:1 meetings with investors and a lunch presentation to a group of investors. Topics included the role compact modular systems would play in shaping operator spending, Chinese spending and technology trends and discussion of the ongoing industry consolidation.

Raymond James released a note summarizing the discussions – some observations are excerpted here:

2018 SCTE Cable-Tec Expo: Key Optical Topics

The SCTE Cable-Tec Expo is the premiere technical trade show for North American Cable MSOs and has historically been oriented towards software, analog hardware, outside plant, and HFC-specific equipment. This year a greater number of prominent optical companies joined in. Factor such as fiber deep, native optics, 5G, and virtualization are driving optical deployments into the MSOs.

2Q18 Optical Customer Markets Report

Cignal AI has issued the 2Q18 Optical Customer Markets Report.