3Q21 Transport Applications Report

Compact Modular equipment sales continued to surge while Chinese coherent port shipments stalled.

3Q21 Transport Hardware Report

Optical forecasts were reduced by $1.1B worldwide in 2025 due to a shift of coherent optics into router-based DCO’s.

2Q21 Transport Applications Report

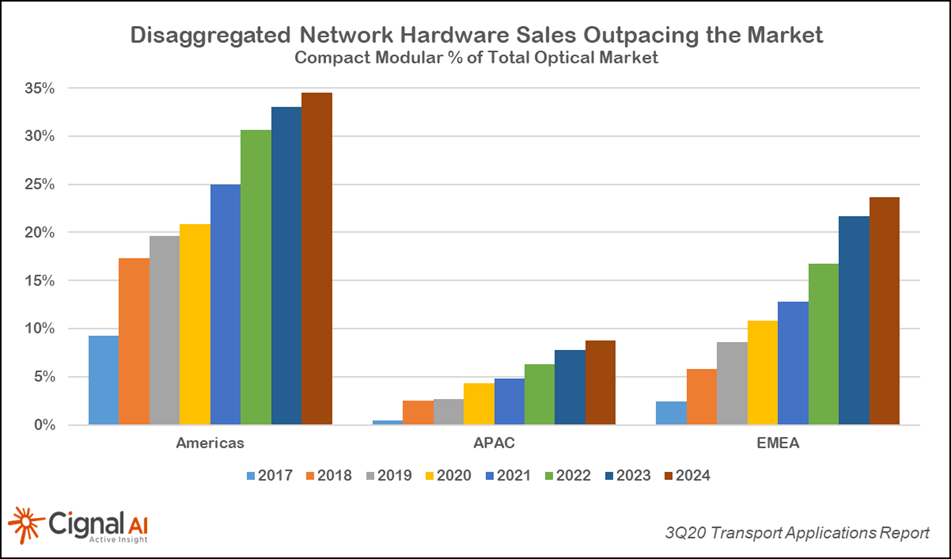

Compact modular sales again outperformed the overall optical hardware market while Packet-OTN sales declined. 400ZR is shipping but is supply limited.

2Q21 Transport Customer Markets Report

Optical spending by North American Traditional Telco carriers declined YoY; Cloud & Colo optical spending worldwide slowed as NA spending stalled.

ADTRAN, ADVA to merge for metro to access play

Mentioned: ADTRAN and ADVA have announced a merger

2Q21 Transport Hardware Report

First-quarter 2021 worldwide optical hardware spending was down slightly YoY, Chinese optical hardware spending was down significantly.

ADVA 2Q21 Vendor Summary Report

Record Q2 profitability – Sales hit by 10% due to supply chain issues – EMEA continues to rebound

1Q21 Transport Applications Report

400Gbps+ port shipments doubled YoY, 400ZR ports started to ship, and compact modular sales significantly outperformed the overall optical hardware market this quarter.

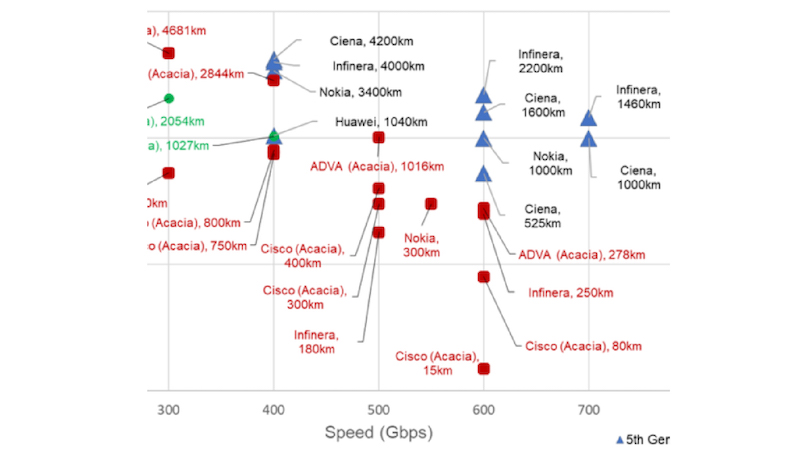

OFC21: 800G Coherent and Beyond

Several vendors are shipping 800Gbps capable coherent optical solutions, and now the industry must consider the next steps in development.

GEN90P Coherent Trials and Deployments

Cignal AI continues to track announcements of 5th generation (800Gbps-capable, 90+ GBaud) optical trials and deployments.

1Q21 Transport Customer Markets Report

Optical spending by North American Traditional Telco carriers declined steeply YoY compared to a heavily frontloaded 1Q20, but show signs of longer term recovery. Cloud & Colo optical spending worldwide slowed as NA spending stalled in 2020 and APAC is just beginning to take off.

1Q21 Transport Hardware Report

First quarter optical spending was down compared to the Covid-impacted 1Q20. Packet transport sales, which suffered a year ago from operational issues, increased sharply.

ADVA 1Q21 Vendor Summary Report

Record Revenue and Orders – North America Rebound Coming – Components Become 10% of Business During Next Three Years

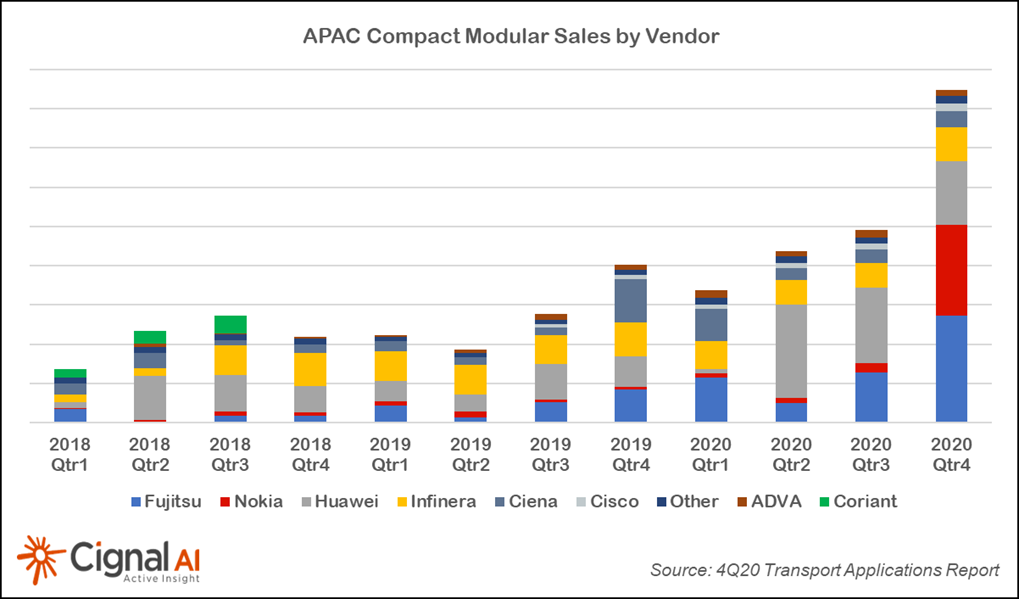

The Growth of Compact Modular in APAC

Compact Modular sales (and hence disaggregation) have historically lagged in APAC versus the rest of the world, so APAC’s sudden and extraordinary growth over the past few quarters means that something has changed and deserves a closer look.

4Q20 Transport Applications Report

4Q20 Compact Modular sales significantly outperformed the overall optical market, as APAC sales more than doubled and surpassed EMEA sales for the first time. 400ZR forecasts for 2022 and beyond were increased based on growing operator interest.

4Q20 Transport Customer Markets Report

North American Traditional Telco spending on optical and packet hardware declined significantly in the 4th quarter, due to a dramatic reshuffling of capex spurred by the pandemic during the first half of 2020. Meanwhile, APAC Cloud & Colo spending exploded. Long term, hardware sales in all markets are predicted to return to growth in the second half of 2021.

4Q20 Transport Hardware Report

North American optical and packet transport spending plummeted in North America as Tier 1s concentrated COVID-related capex in the first half of the year.

2021 Outlook: Optical & Packet Transport

This report provides a summary of Cignal AI’s current outlook for the year. Creating forecasts for 2020 was uniquely challenging and forecasting the expected return to normal by the end of 2021 is also very complex.

3Q20 Transport Applications Report

Compact modular sales grew much faster than the optical market overall, with significant growth in APAC this quarter. 400ZR and ZR+ modules began sampling with several hundred modules shipped for evaluation.

3Q20 Transport Customer Markets Report

North America transport hardware spending growth shifted dramatically this quarter from Cloud & Colo operators to Incumbents. APAC Cloud & Colo optical sales grew again.