Compact Modular Optical Hardware Outpaces Projections as Adoption Extends Outside Cloud and Colo Customers

BOSTON (April 17, 2018) –Networking component and equipment market research firm Cignal AI has updated its growth forecast for the coherent 400G WDM market. The optimistic outlook is supported by expanding applications for pluggable 400G ZR, as well as the improved performance of 400G+ equipment across all distances.

These conclusions are captured in Cignal AI’s most recent Optical Applications Report, which includes full 2017 port shipment results and market share for all equipment vendors. The report also offers insight into projected growth in the compact modular hardware segment, which enables disaggregated hardware optical network deployment models.

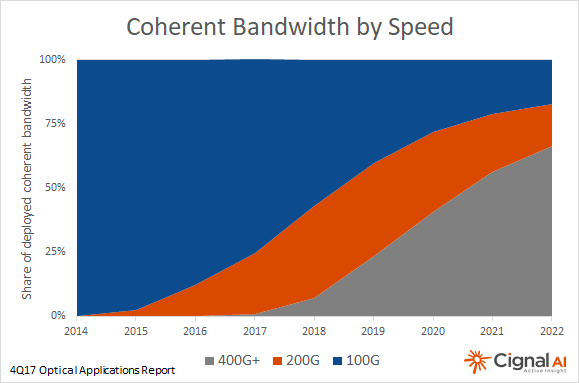

“Coherent 400G will cap the growth of existing 200G and 100G technologies by 2020 as new equipment becomes available that maximizes optical capacity independent of reach,” said Andrew Schmitt, lead analyst for Cignal AI. “Compact modular equipment is the enabling platform, with revenue almost quadrupling in 2017, and we expect that it will continue to grow at least 40 percent per year through 2022.”

The Optical Applications Report is issued quarterly, and the most recent report updates market share for 2017 and provides forecasts in three key markets: 100G+ coherent WDM, compact modular equipment, and advanced packet-OTN switching hardware.

Key report findings include:

100G+ Coherent WDM

- Shipments of 100G+ coherent ports grew rapidly in Western markets, increasing more than 50 percent for 2017 and outpacing growth in China for the first time.

- Despite the increased port shipments, a challenging pricing environment kept revenue growth flat.

- Coherent 200G now accounts for more than 10 percent of the market, with shipments led by Ciena and Nokia.

- 2018 will usher in more market stability with less disruption by new companies and technology. A better pricing environment and improved financial results are expected as a result.

- Significant 400G growth will not begin until 2019, as Ciena is the only production supplier of this technology in 2018.

Compact Modular Equipment

- 2017 revenue for this segment quadrupled as cloud and colo vendors migrated their hardware architectures to the new form factor.

- Ciena and Cisco were the beneficiaries of this growth because of their state-of-the-art systems. These two vendors along with Infinera accounted for most shipments during 2017.

- Hardware disaggregation is driving interest in this category, as operators begin to embrace this model to gain greater supply chain flexibility. Cable MSOs, wholesalers and incumbents such as AT&T are showing interest in compact modular equipment to build disaggregated networks.

- The compact modular market continues to climb an upward trajectory, with products increasingly adopted by a wide range of operators. Cignal AI expects the market to expand rapidly as carriers outside of the cloud vertical utilize this equipment, creating multiple market entry points for a variety of vendors.

Advanced Packet-OTN Switching

- Large incumbent operators continue deployments of these systems. Despite the complexity, advanced packet-OTN switching remains the best approach for unifying multiple legacy networks and applications onto a single transport infrastructure.

- This market grew 35 percent in 2017 with strong shipments in China and EMEA, which primarily benefited Huawei and Nokia.

About the Optical Applications Report

The report includes market share and forecasts for revenue and port shipments for optical equipment designed to meet the needs of specific applications: 100G+ coherent, compact modular and advanced packet-OTN switching hardware. Deliverables include an Excel file with complete data set, PowerPoint summary and Optical Equipment Active Insight.

The report features revenue-based market size and share the hardware categories, and detailed port-based market size and vendor market share for 100G+ shipments. Vendors examined include: Acacia, Adtran, ADVA, Ciena, Cisco, Coriant, Cyan, ECI, Ekinops, Fiberhome, Fujitsu, Huawei, Inphi, Infinera, Juniper Networks, NEC, Nokia, NTT Electronics (NEL), Padtec, TE Conn, Transmode, Xtera and ZTE.

Full report details, as well as articles and presentations, are available to users who register for a free account on the Cignal AI website.

About Cignal AI

Cignal AI provides active and insightful market research for the networking component and equipment market and the market’s end customers. Our work blends expertise from a variety of disciplines to create a uniquely informed perspective on the evolution of networking communications.

Contact Us/Purchase Report

Sales: [email protected]

Web: Contact us

Link to Release